[ad_1]

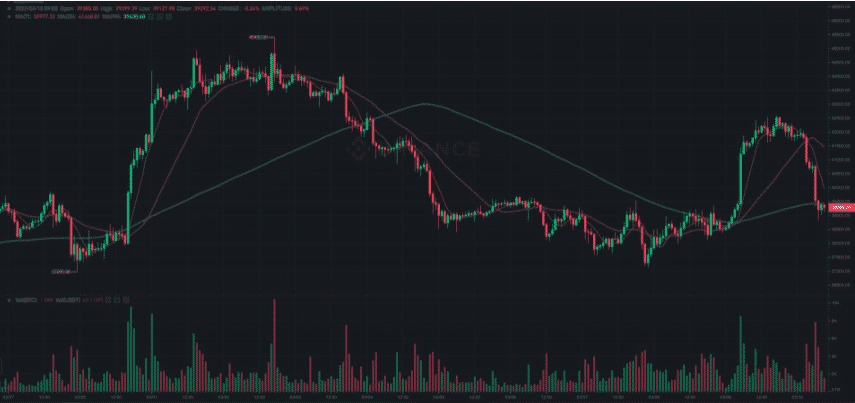

$100B erased from the market after Bitcoin retraced following Biden’s signing of the executive order in what seems to be a classic Bart pattern so let’s read more today in our latest bitcoin news.

Bitcoin lost most of yesterday’s gains as the market saw $100B erased from it in the process. The crypto market lost $100 billion in the past 24 hours as the BTC price retraced from its yesterday pump which was induced by the release of President Joe Biden’s order on digital assets. Bitcoin’s price increased from $39,000 to $42,000 in a huge surge which was caused by the release of the long-awaited executive order on digital assets which has to be signed by the US President.

The order detailed a future where people and authorities can both benefit from crypto in a sustained and regulated environment which is something that most proponents of the industry expected. However, the text was much friendlier than anticiapted and resulted in a huge market pump. Fast forward 24 hours, the gains are gone and BTC painted a classic Bart pattern on the charts and they retraced to where it was trading before the surge as can be seen from the charts.

The broader crypto market shed $100 billion while BTC was dropping and the rest of the altcoins also dropped but not as considerable. The entire market is painted in red and most of the altcoins declined less than Bitcoin did. For example, Luna is down by 0.9%, XRP is down 2.65%, and so on. The biggest gainer in the past day was WAVES whcih increased 22.5% over the period and it is followed by RUNE which increased by 4%. on the other side, Monero’s XMR lost the most by 10.9% and was closely followed by Fantom which dropped by 10.4%.

The cryptocurrency market went through heavy volatility in the past few days and left a trail of liquidations worth $215 million in the past day. Bitcoin’s price surged towards $42,000 after the news of President Biden signed the executive order on crypto. The document’s text was perceived well by the market and it failed to outline particular worries outside of what the industry factored in advance however today, in a u-turn of events, after $215 million got liquidated, Bitcoin’s price dropped by $3000, marking a decline of 7.5%.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

[ad_2]

Source link