Celsius Is Scrambling To Wind Down The DeFi Activity And Here’s How

July 10, 2022 | by olympieioncryptonews

[ad_1]

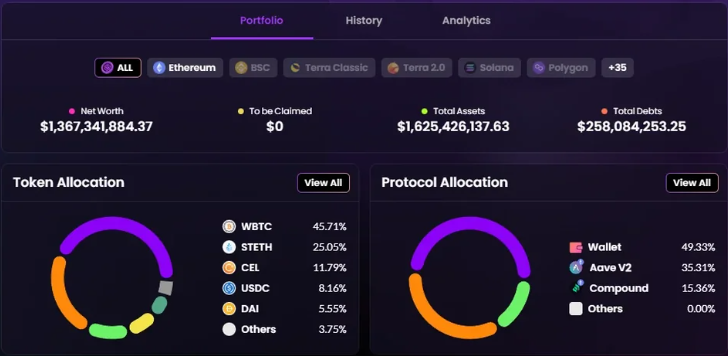

Celsius is scrambling to wind down the activity in the DEFI space after a closer look at the wallet data on ApeBoard which shows that the platform will even be possible to delay the inevitable so let’s read more today in our latest cryptocurrency news.

One of the best parts of the DEFI space is the transparency and the recent events in the markets made that clear. Everyone on the market can see who is borrowing what and how much they are borrowing but also what is the rate of the liquidation. If you compare this to various deals Three Arrows Capital conducted, some of the partners were made without any collateral and based on the word of the 3ac crew. During the crypto market crash, it was interesting to see how the liquidation mechanisms in the DEIF space operated. There were no backdoor deals to save the positions and the rules like the loans were also fully transparent.

If you want to borrow Wrapped bitcoin on Aave for example you would have to be aware of the 80% liquidation threshold which doesn’t matter if you are the biggest hedge fund or smaller users based somewhere in India. The rules are the same for everyone. With this in mind, you can equip yourself with other ways to measure the health of the larger lenders and they are able to then identify the wallets of the platforms and watch as they enter into liquidation. This week, we got a first-hand look at how Celsius topped up several of the DEFI positions.

After collecting crypto wallets that belong to the lender, the activity on Apeboard was addressed which is a handy visualizer for wallets rather than just using Etherscan and following up the strings of letters and numbers that the platform showing how wallets are operating. The tool is handy because you can see which tokens are held in larger amounts. The history tab of the crypto transactions for the Aave wallets for example shows that one of Celsius’ wallets paid about $50 million in loans to Compound in three transactions. It also seems that Celsius paid another $50 million USDC loan to Aave.

This is little more than $100 million in debt repayment and it seems that Celsius is scrambling to get the books in order but whether it will come out on top or delay the inevitable remains to be seen. While the wallet analysis might be compelling, one user suggested that SBF is looking for books and was beyond savings.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

[ad_2]

Source link

RELATED POSTS

View all