Terra’s LUNA Token Passed ETH To Become Second Biggest Staked Asset

March 2, 2022 | by olympieioncryptonews

[ad_1]

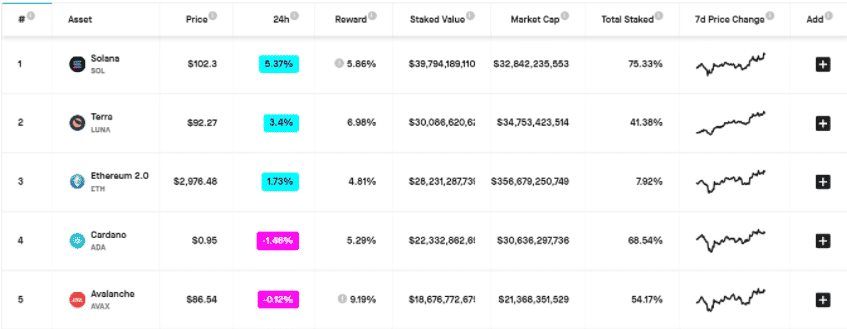

Terra’s LUNA token passed Ether to become the second biggest staked asset with some $30 billion of the tokens being staked and earning yields under 7% so let’s find out more today in our latest altcoin news today.

The price surge in Terra’s LUNA token over the past week made it the second biggest staked asset among the major cryptocurrencies in terms of total value staked and LUNA ever surpassed ether which has over $28 billion in staked value. The data from Staking Rewards shows over $30 billion worth of LUNA which is not staked directly on various protocols which represent most of the token’s $34 billion market cap. The participants are earning more than 6.98% in annual yields and some 41% of the eligible tokens are staked as the data shows.

The cross-chain protocol Orion. money holds about $2 billion in staked LUNA with the largest among all applications that support LUNA, having 43,000 stakers generate about 7% in yields. The prices of LUNA increased 70% over the past week and showed some strong fundamentals and has a positive sentiment among the Terra community. LUNA is one of the two tokens issued by Terra which is a blockchain protocol that uses the dollar-pegged stablecoin UST that will build a global payments system. LUNA is among the best performing cryptocurrencies over the past few years and it had a 76,130% rise since the lows of March 2020.

Staking in crypto refers to a process where the token holders deposit or lock away tokens to become active participants in running the network in return for the rewards. The rewards are referred to as yields which are often higher than those offered on deposits by traditional institutions. SOL tokens remain the most staked asset with more than $40 billion worth of SOL staked on various protocols and stakers can earn some 5.86% in yields per year.

ETH retains still its crown in terms of total value locked on applications that are built on the blockchain and over $118 billion is locked on the ETH-based apps compared to the $23 billion on the Terra-based apps with $7 billion on Solana-based apps data from DefiLlama shows.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

[ad_2]

Source link

RELATED POSTS

View all