[ad_1]

The global crypto market cap fell more than 5% to $1.66 trillion today. Top cryptocurrencies Bitcoin, Ethereum, BNB, Solana, XRP, Cardano, and others tumble 5% in just an hour. BTC price fell 7% to below the $41,000 level, erasing the gains on after New Year’s Day. On the other hand, Ethereum (ETH) price fell 8% to a hit of $2,200.

The crypto market saw over $600 million in liquidation in the last 24 hours, with $500 liquidated in just an hour. Coinglass data indicate massive longs liquidation of over $$561 million today, January 3. More than 176K traders were liquidated in the last 24 hours, with the largest single liquidation order on Huobi’s BTCUSDT worth $14.26 million.

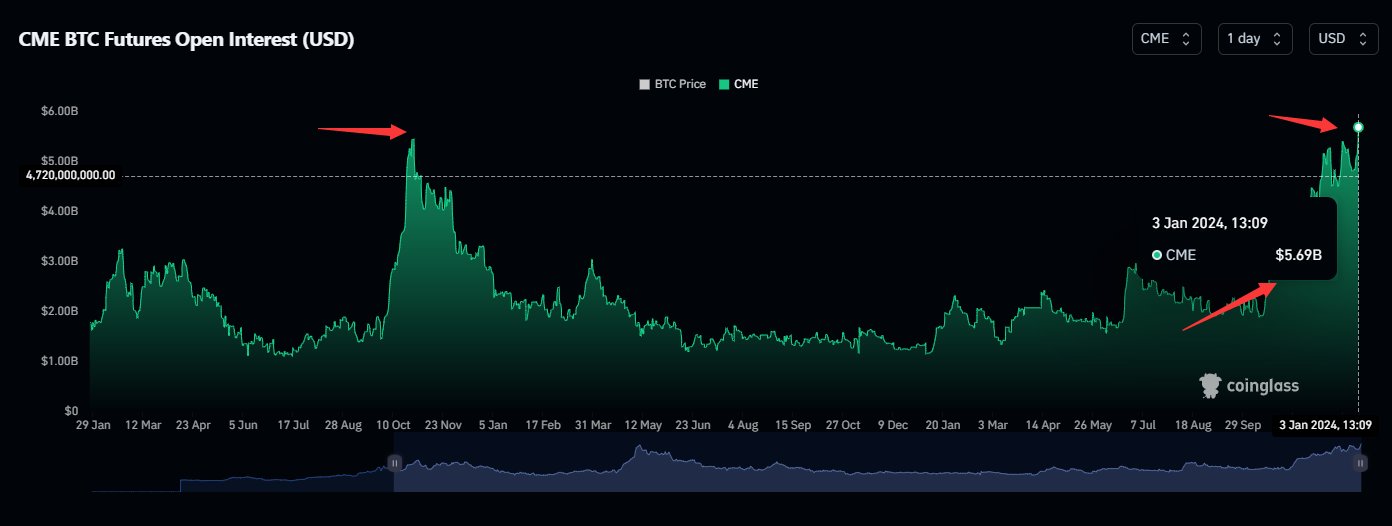

CME Bitcoin Futures OI Slips From Record High

Global derivatives marketplace Chicago Mercantile Exchange (CME), which overtook crypto exchange Binance in terms of Bitcoin futures trading in November last year. CME Bitcoin futures open interest (OI) hit a record high of $5.69 billion on Wednesday amid spot Bitcoin ETF approval hype and FOMO after BTC price.

Coinglass on January 3 reported Bitcoin futures open interest (OI) on CME hitting a new high of $5.69 billion. The last time CME Bitcoin futures open interest hit an all-time high was in October 2021 when BTC price was trading above $60,000. In the next two months, BTC price tumbled below $40,000.

In addition, the total Bitcoin futures OI on all exchanges dropped by 9% to $18.17 billion from $20.23 billion. In the last 4 hours, BTC OI fell by 6% on CME and 16% on Binance. Also, BTC options data indicates that puts are gradually increasing in the last 24 hours, indicating a selling by options traders.

Meanwhile, Matrixport has shaken the crypto community with a bold forecast on Bitcoin price and SEC’s decision on Bitcoin Spot ETF. According to the latest report, the U.S. Securities and Exchange Commission (SEC) is anticipated to reject all Bitcoin spot ETFs in January, potentially triggering a sharp decline in Bitcoin’s value to as much as $36,000.

Also Read: Bitcoin Bull Cathie Wood’s Ark Invest Extends Coinbase And Robinhood Selling Spree

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

[ad_2]

Source link