[ad_1]

The crypto market saw $250 million liquidated over the last 24 hours, with $60 million Bitcoin longs liquidated from a total of $70 million. BTC price fell under key $40,000 support level as traders and experts anticipated a weak trend due to macro and technical reasons.

However, a correction in Bitcoin price has been pending since December after a rally triggered by massive buying from retail and institutional investors. CoinGape reported a CME Bitcoin gap near $39,700, which has finally filled as Bitcoin drops to a 24-hour low of $38,923.

Peter Brandt Shares Bullish Outlook

Reacting to Bitcoin price prediction to popular trader Cheds that side-liners will again take long positions under $40,000, Peter Brandt agrees the decline is most probably a wash out of weak longs.

In contrast to bearish sentiment and weak buying from bulls below $40K, Peter Brandt said “Would love to see what would happen when (if) parabola is retested.”

As the major support is broken and CME Bitcoin gap is filled, buying from the dip for longs is expected. However, the parabola shared by Peter Brandt depicts a retest most likely in Feb-end or early March.

March will be a crucial month for BTC traders in terms of macro and post-Bitcoin halving sentiment. The world will keep an eye on the US Federal Reserve monetary policy decision in March for a pivot. The macro currently is against the Bitcoin bullish momentum.

The U.S. 10-year treasury yield hovers near 4.15%. The US dollar remains strong reversed back to 103.50 from 101 in early January, currently at DXY index is at 103.29. Bitcoin traders brace for key economic data this month end including US Treasury quarterly refunding announcement on January 31.

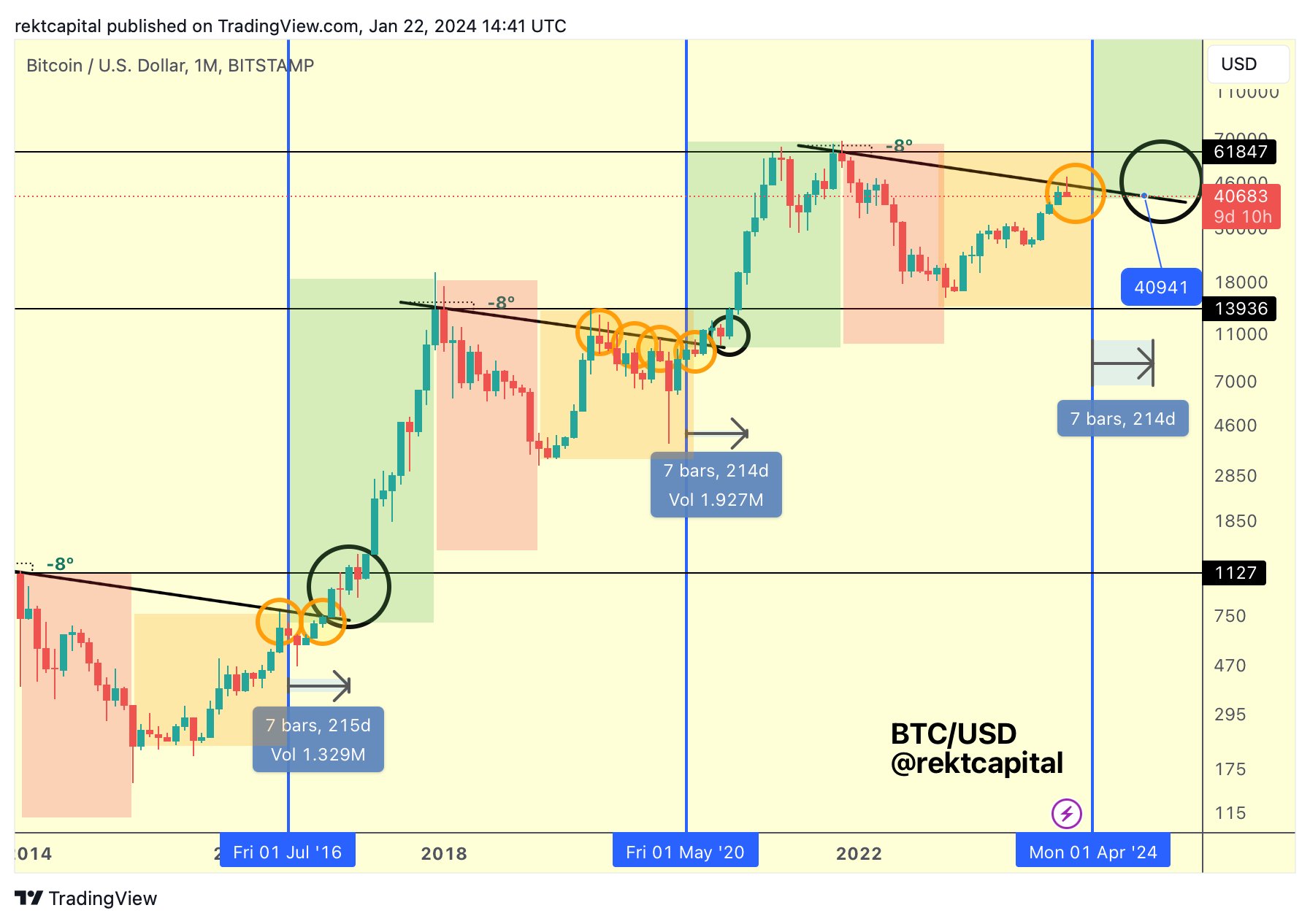

Whales have sold around 70,00 BTCs worth over $3 billion in the last two weeks, reported popular analyst Ali Martinez. Analyst Rekt Capital revealed that Bitcoin is repeating historical chart patterns over correction before a halving.

BTC price fell 5% in the past 24 hours, with the price currently trading at $38,964. The 24-hour low and high are $38,839 and $41,242, respectively. Furthermore, the trading volume has increased by 85% in the last 24 hours, indicating interest among traders.

Also Read:

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

[ad_2]

Source link