[ad_1]

Bitcoin and Ethereum prices, leading crypto and indicators for the crypto market, will witness volatility on Friday as global investors brace for first monthly expiry after spot Bitcoin ETFs approval and listing.

BTC price and trading volumes took a hit after spot Bitcoin ETFs listing, with prices tumbling below the $40,000 psychological level to a low of $38,521. Crypto fear and greed index slipped from 80 (extreme greed) on Jan 11 to 49 (neutral) today, indicating swift changes in the sentiment.

Bitcoin and Ethereum $5.7 Billion Options Expiry

Notably, 93,588 BTC options of notional value $3.7 billion are set to expire on January 26, with a put-call ratio of 0.52. The max pain point is $41,000, indicating that traders are under selling pressure. Traders can expect huge volatility as BTC price is currently trading below the max pain price at $40,059.

Total BTC futures open interest increased 0.41% over the last 24 hours, with 0.60% rise in 4 hours. BTC open interest fell 2% to $4.59 billion on CME but up 1% to $4.11 on Binance. Also, total BTC options open interest is at $15 billion.

Moreover, 929,432 ETH options of notional value $2 billion are set to expire, with a put call ratio of 0.31. The max pain point is $2,300, which is also higher than the current price of $2,220. Traders couple be awaiting a recovery above max pain point, but the scenario could fail due to other pressure with a sudden price change.

Meanwhile, total ETH futures open interest is $7.78 billion, dropped 0.56% in the last 24 hours and rose 0.28% in the last 4 hours. There is significant increase on top three ETH futures exchanges Binance, Bybit, and OKX.

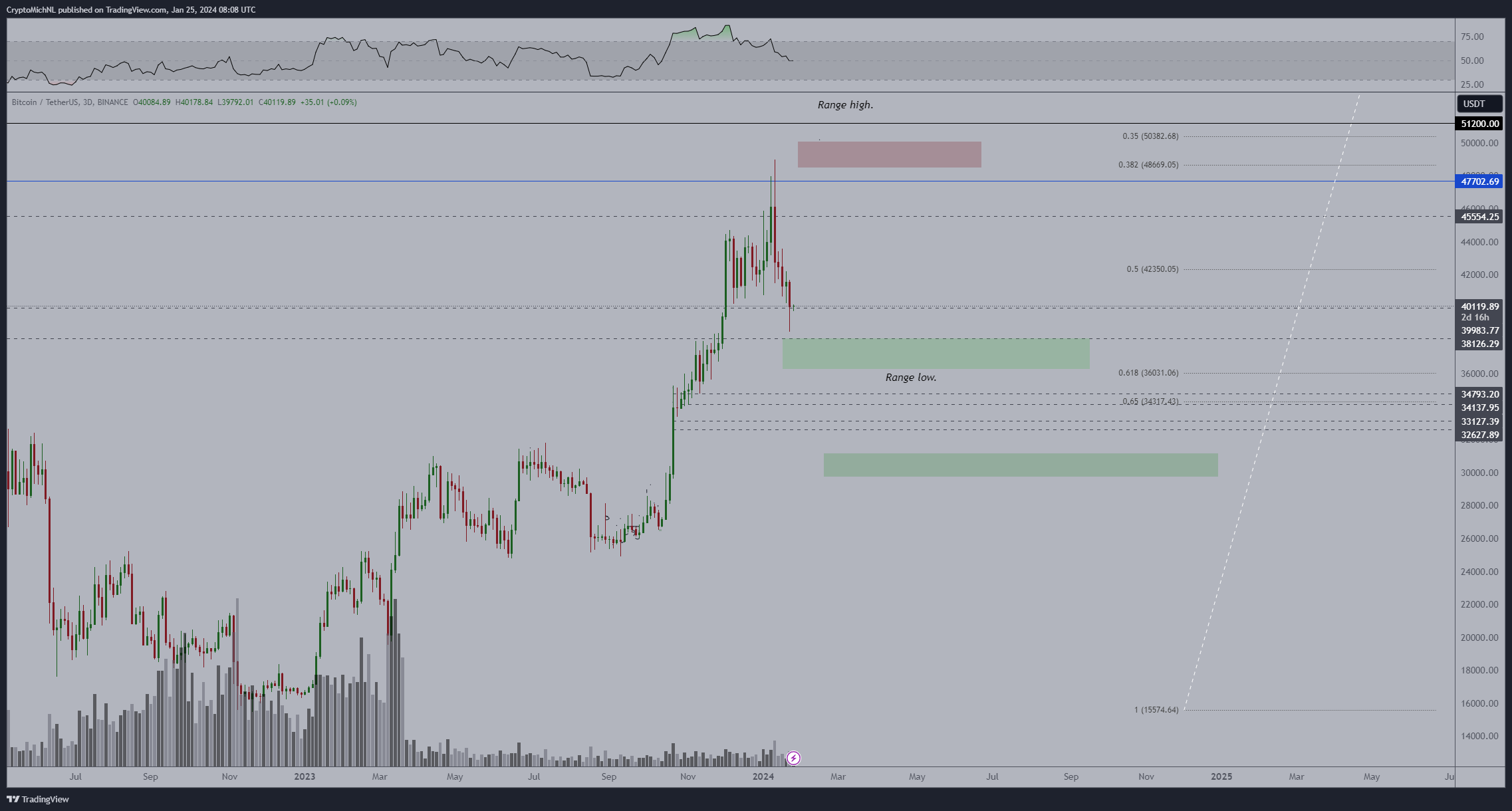

Popular analyst Michael van de Poppe predicts decrease in volatility from here as BTC enter final stages of this correction. The range-low is still $36-39K, with upward momentum to the Bitcoin halving starting soon. However, analysts have warned about massive liquidation if BTC falls below $38,130.

Also Read: Bitcoin Whales Have Been Buying Every Dip, BTC Price Recovers to $40,000

Macro Trend On The Mark

The next few days are crucial for crypto and stock markets as multiple macro data release are in line from today onwards that would impact the U.S. Federal Reserve interest rate decision on Jan 31.

US GDP growth in Q4 has seen slowing to 2%, the lowest growth in six quarters and much less than 4.9% growth rate in Q3. The Fed’s tightening campaign took a hit on the economy, but tight labor market provide enough support to consumer spending.

Markets also look ahead to Friday’s US PCE inflation data, the central bank’s preferred inflation gauge. The market expect annual core PCE to drop to 3% from 3.2%.

The US 10-year Treasury (US10Y) was around six-week highs of 4.16% and US dollar index (DXY) at steady at 103.20, as traders await key economic data to assess the performance.

Also Read: Ripple Sends Letter To Judge Netburn Over SEC’s “Factual Mischaracterization”

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

[ad_2]

Source link