[ad_1]

Markus Thielen, chief executive officer of 10x Research, on Monday said new highs for Bitcoin price are coming. He was one of the first few analysts who predicted a BTC price retracement to $38,000 post-spot Bitcoin ETF approval based on Bitcoin wave patterns.

The crypto market rally faced headwinds amid uncertainty due to low trading volumes and negative sentiment surrounding GBTC outflows. However, the short-term market sentiment remains bullish.

Best Range To Buy Bitcoin For $50,000

Markus Thielen, former head of research at Matrixport, in a new report on January 29 predicts an upcoming Bitcoin (BTC) price rally as wave 5 begins. He anticipates BTC price reclaiming 50,000 level by the end of this quarter.

“With reversal indicators suggesting that a tradeable low is in, we should focus on longs. From a risk management perspective, we should re-engage in long positions once bitcoin breaks above $43,000, said Markus Thielen.

He suggests buying Bitcoin above $43,000, despite the minor resistance at $43,000-44,000 range. As per the Elliot wave theory, Bitcoin’s retrace wave 4 has ended and impulse wave 5 has begun.

Thielen further added that declining GBTC outflows and Google supporting Bitcoin and crypto ETF advertising from today are potential catalysts to upside momentum in BTC price.

Also Read: Futures ETF Is Not Required For Spot XRP ETF Approval Says Bloomberg Analysts

Other Crypto Analysts’ Predictions

Top crypto analyst Michael van de Poppe says Bitcoin correction in response to spot Bitcoin ETF listing has likely ended. He expects a rebound in altcoins to start in the next 1-2 weeks “when ecosystems are thriving in returns before Bitcoin breaks the highs again.”

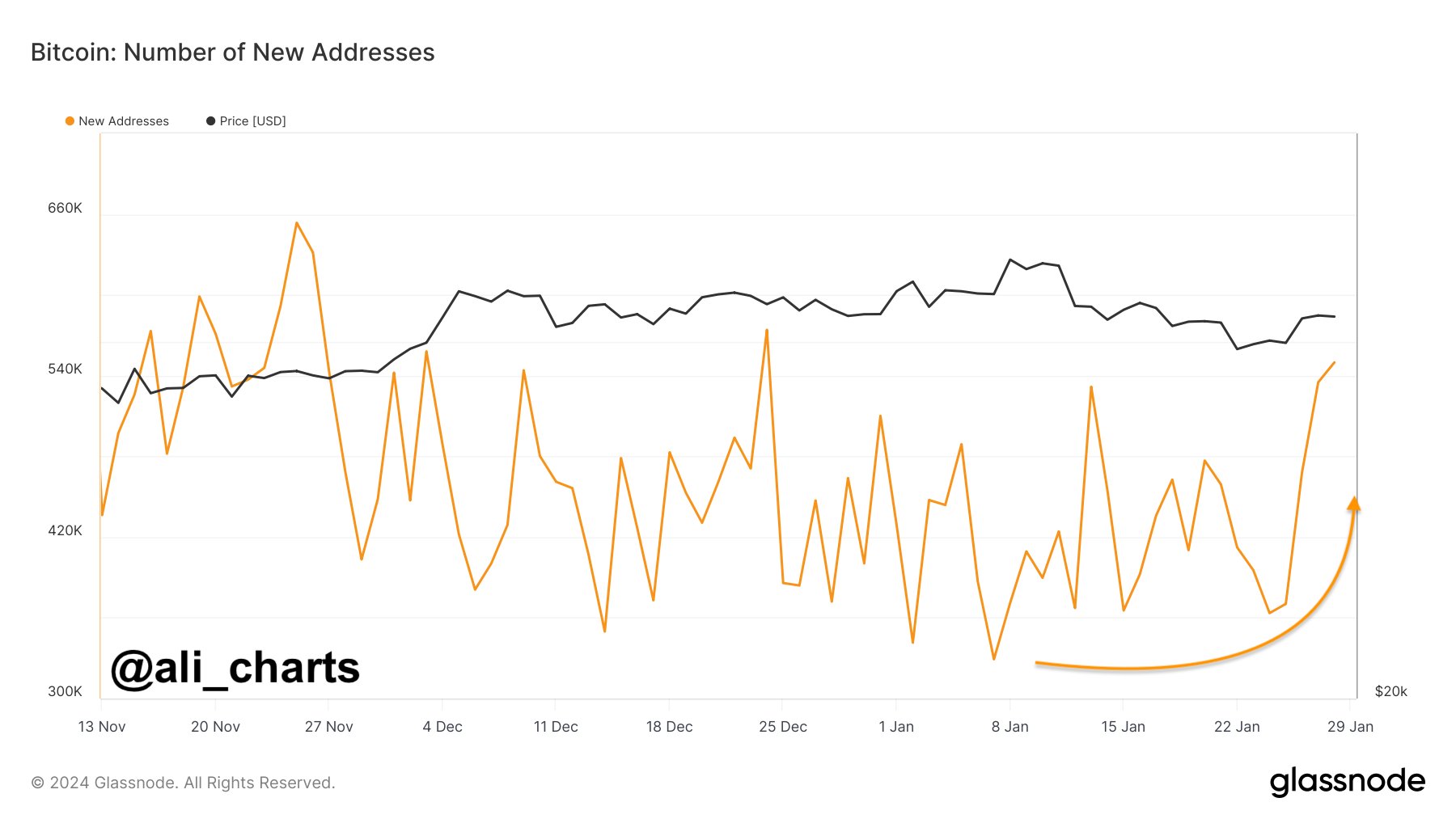

Analyst Ali Martinez revealed a rise in new Bitcoin addresses that indicates a growing wave of interest among investors. He believes many investors have been buying the dip.

BTC price fell 1% in the past 24 hours, with the price currently trading at $42,197. The 24-hour low and high are $41,696 and $42,681, respectively. Furthermore, the trading volume has decreased by 10% in the last 24 hours, indicating a rise in interest among traders.

Also Read: Fed’s Rate Cuts Likely In March Before Bitcoin Halving, Will BTC Price Rally?

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

[ad_2]

Source link