[ad_1]

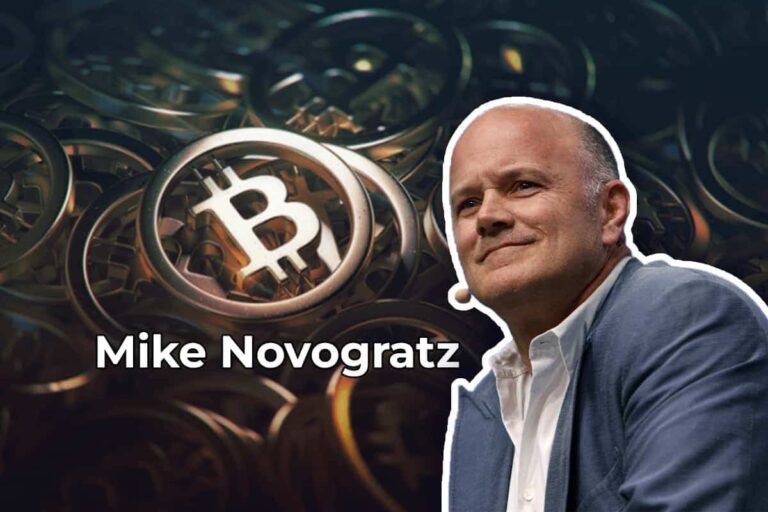

Galaxy Digital CEO Mike Novogratz believes that leading cryptocurrency by market capitalization Bitcoin (BTC) will resume its upward trend once the bloodbath in the broader market abates.

Galaxy Digital Boss Sees Imminent Bitcoin Resurgence

Novogratz started his X post by first acknowledging that wars cost money. He prayed against the occurrence of a bigger war which he believes would largely impact Bitcoin price.

His statement suggests that the continuation of the war would lead to more price drops for financial assets with reference to Bitcoin. If not, the coin may even move to hit another all-time-high (ATH).

“I pray cool heads prevail and this is not the start of a major regional conflict,” Novogratz said. “There are so many good things going on in the mid east, it’s just tragic that we are here.”

Wars cost $$$…. Praying we don’t get a bigger one but after the risk flush, $BTC will resume its trend higher.

I pray cool heads prevail and this is not the start of a major regional conflict.

There are so many good things going on in the mid east, it’s just tragic that…

— Mike Novogratz (@novogratz) April 13, 2024

Asides the termination of the war, Bitcoin is likely to experience a surge in the coming days. The Bitcoin halving event is speculated to bring a potential bull run to the asset and the broader market. This expectation has led investors into hoarding Bitcoin-related assets through the BTC leveraged ETF.

Nations like Hong Kong are also preparing to greenlight spot Bitcoin ETFs this month, demonstrating a widespread adoption of the flagship cryptocurrency. Should this eventually happen, there is a possibility that BTC price will retrace its bearish trend and hit a new high.

Israel Hamas War Impacting Crypto Prices

There has been bloodshed since October 7, 2023 when a conflict arose between Israel and Hamas.

Unfortunately, the geopolitical tension has impacted negatively on the global financial market and on the prices of cryptocurrencies including Bitcoin, Ethereum, BNB and Solana.

Bitcoin climbed to a new ATH of $73,000 a few weeks back. At the time, the increase in Bitcoin’s price was linked to a number of events like the United States Securities and Exchange Commission (SEC) greenlighting spot Bitcoin ETFs from reputable asset management firms including BlackRock, Fidelity and Grayscale.

The escalation of the ongoing Israel and Hamad war has contributed to triggering a drawdown in the price of the coin which pulled the asset down to $62,000 recently.

Markedly, the recent price drop was registered at the time when Israeli military announced that Iran had attacked the country by launching “dozens” of drones.

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

[ad_2]

Source link