[ad_1]

Crypto market has lost over $430 billion in market value as Iran-Israel tensions become more intense. The global crypto market cap by 20% from $2.64 trillion to a low of $2.21 trillion amid panic selling. The market reaction on Monday will be important as the sudden crash erodes confidence.

What happens between Iran and Israel? Iran is threatening retaliation, with initial drone attacks on Israel, after claiming that an airstrike on the Iranian consulate in Damascus, Syria killed officials including high-ranking generals. Israel neither confirmed nor denied its involvement in the attack.

The week was bad for the crypto market spurring negative sentiment, while some remain calm due to expected correction pre-Bitcoin halving similar to past halving events. BTC price fell further to a low of $60,660 but rebounded to $64,300 resistance level in a few hours. BTC price is now trading at $64K.

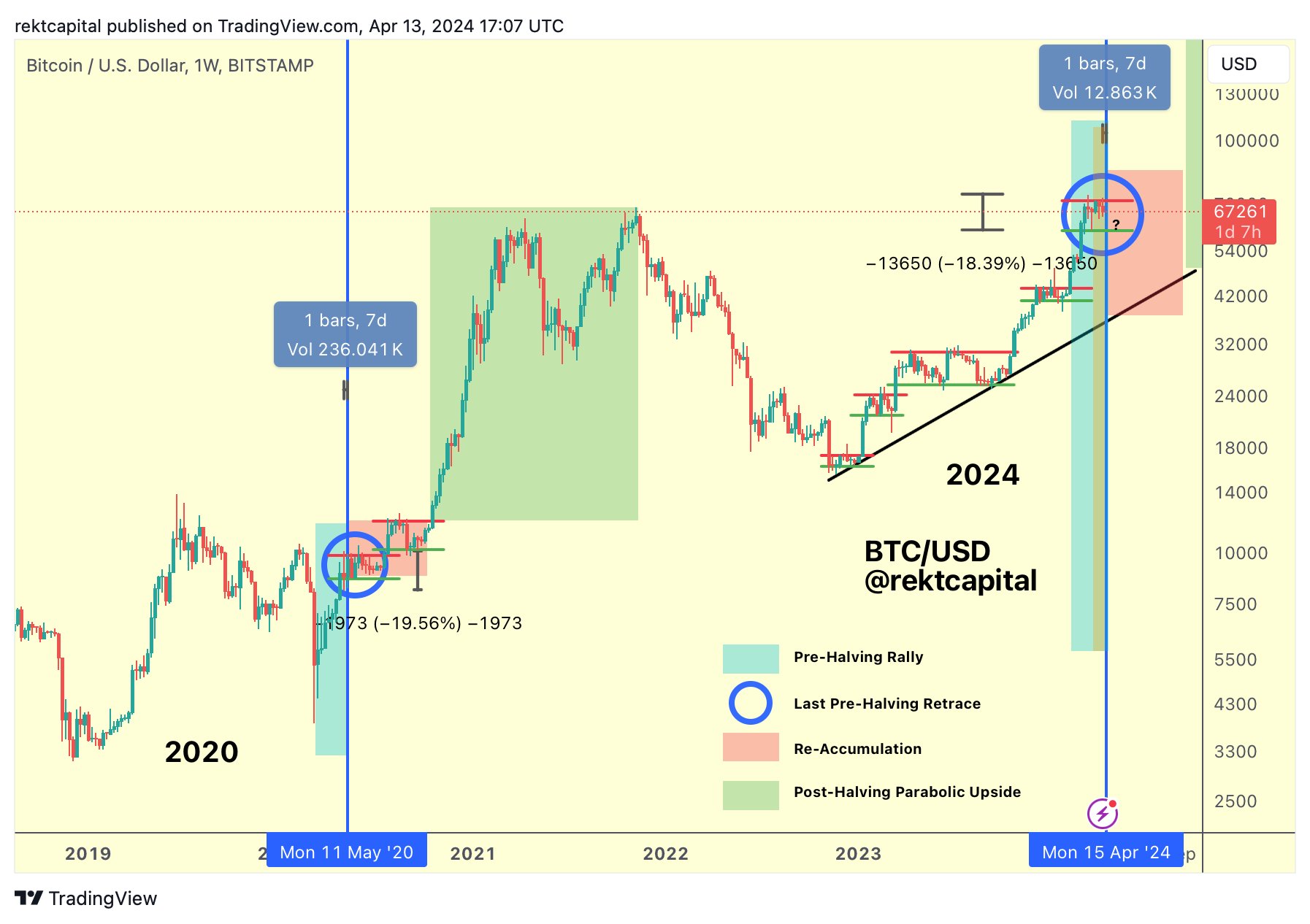

Rekt Capital asserts the current Bitcoin cycle has been accelerated compared to previous ones. He said “New all time highs before the halving is an apparent sign of that. But this current retrace and sideways movement in the Re-Accumulation Range is exactly what is needed to decelerate and slow down the cycle.” These retraces and periods of consolidation to get this current cycle closer to resynchronizing with historical cycles, he added.

ETH price has further dropped 9% to drag the price below $3,000. This caused altcoins SOL, XRP, ADA, DOGE, SHIB, and others to extend their downfall to 20-50%.

As ETHBTC plunges to the 2021 levels of 0.46, analyst Benjamin Cowen predicts ETH/BTC might bottom this summer. Last cycle, ETHBTC bottomed after the 1st rate cut after it broke support and “dropped for 2 months straight, then bottomed.”

While whales are buying considering the buy-the-dip opportunity, a major risk arises in the DeFi market. As CRV fell to $0.42, Curve founder Michael Egorov faces liquidation of his lending positions. Michael pledged a total of 371 million CRV (approx. $156 million) through 5 addresses on 6 lending platforms to borrow $92.54 million in stablecoins. Currently, the health rate has dropped to around 1.1, risking liquidation.

Coinglass data shows more than $2 billion were liquidated across the crypto market amid this strong panic selling. Of these, nearly $1.5 billion long positions were liquidated and nearly $500 million short positions were liquidated since Friday. On Saturday, the crypto market witnessed another $950 billion liquidation.

In the past 24 hours, Over 252K traders were liquidated and the largest single liquidation order happened on crypto exchange Binance as someone sold BTC valued at $8.46 million.

CoinGape has reported the crypto market crash in detail, giving insights into how it started, other reasons for the correction, and experts’ prediction on how low can Bitcoin fall before it starts to bounce. Traders and investors must remain cautious before the latest data on the US dollar index (DXY) and US 10-year treasury yield comes. CME Bitcoin futures contract trades to also open today at 5 PM CT, giving further guidance on market direction.

Read More: Crypto Market Crash — Here’s Why Bitcoin, ETH, SOL, XRP, SHIB Fell Sharply

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

[ad_2]

Source link