As LUNA’s Price Drops Over 33% in 24 Hours, Stablecoin UST Slips Below $1 Parity to $0.93 – Bitcoin News

May 9, 2022 | by olympieioncryptonews

[ad_1]

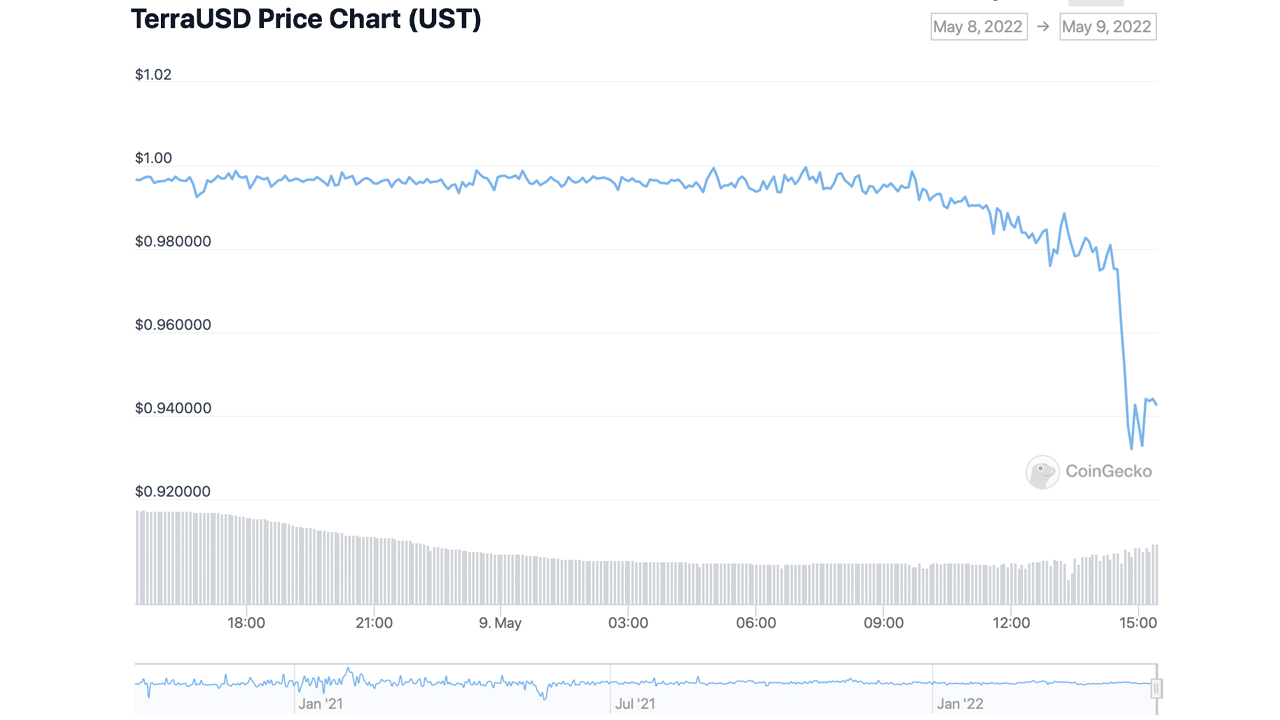

As bitcoin dropped to fresh new lows on Monday, the price of terra (LUNA) slid by 33.3% during the last 24 hours. Moreover, the project’s stablecoin terrausd (UST) has lost stability, dropping to $0.932008 per token. Additionally, the Luna Foundation Guard’s bitcoin wallet and ethereum Gnosis safe address has been emptied.

LUNA Price Puts Intense Pressure on Terra’s Stablecoin UST

During the past 24 hours, more than $830 million has been liquidated from the crypto economy, and the price of bitcoin (BTC) sunk to lows not seen since January 2022. Over the past seven days, BTC has shed 20.2% in value against the USD, and 11% of the value was shaved during the past 24 hours. Furthermore, numerous crypto assets have seen deeper losses as terra (LUNA) dropped by 33.3%.

The stress has caused the project’s UST peg or $1 parity to slip beneath the dollar value. At its lowest point on Monday, terrausd (UST) dipped to $0.932008 per unit according to Coingecko.com statistics. UST’s 24-hour price range on Monday has been between $0.932008 to $0.999601 per unit.

Luna Foundation Empties Bitcoin and Ethereum Wallets

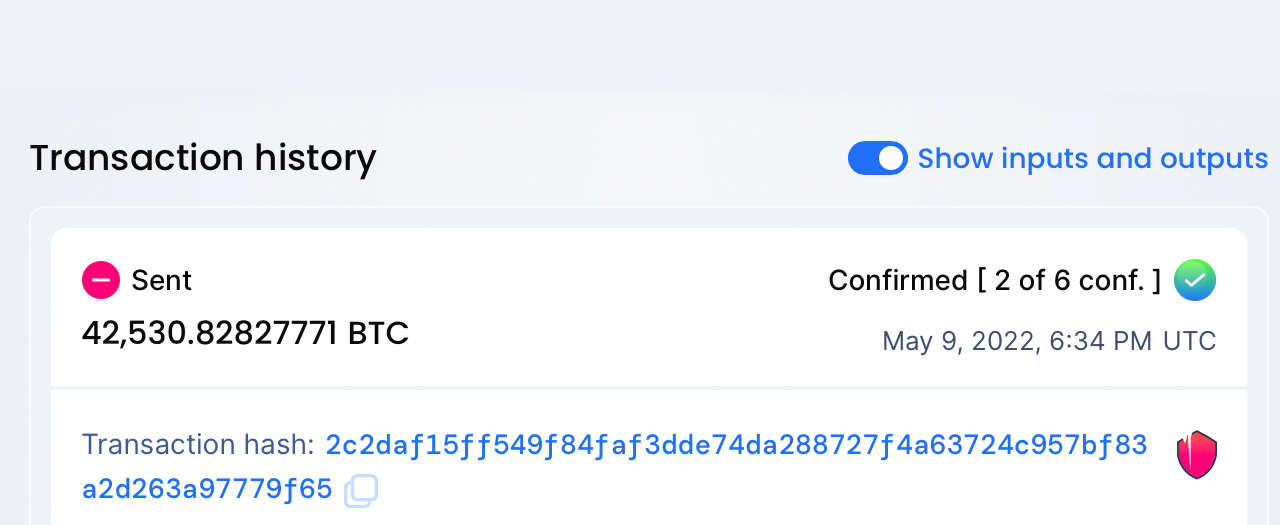

In addition to the losses, UST and LUNA took on Monday, after revealing the Luna Foundation Guard (LFG) would lend $1.5 billion in BTC and UST, both LFG’s public bitcoin and ethereum wallets have been drained. The LFG bitcoin wallet once held 42,530.82 BTC but sent the entire stash in a single transaction to another wallet. Additionally, LFG’s Gnosis safe address, which once held millions of dollars in USDC and USDT, has also been drained.

Deploying more capital – steady lads

— Do Kwon 🌕 (@stablekwon) May 9, 2022

On May 3, the LFG Gnosis safe address held $143 million and today, it currently holds $195. At 2:36 p.m. (ET), Terra co-founder Do Kwon tweeted “Deploying more capital – steady lads.” UST’s price has seen some improvement on Monday after the deployment of capital, but has been down between 4.5 to 6.5% during the last few hours.

While other stablecoin assets like USDC and USDT have felt pressure today seeing much smaller percentage losses, the two largest stablecoins by market cap have held their pegs. Tether slipped down to $0.995691 per unit on Monday while usd coin (USDC) dipped to $0.994630 per unit.

Binance usd (BUSD) is exchanging hands for $0.996616 and DAI has been trading for $0.995420. Most USD pegged stablecoins besides UST remained trading for at least $0.975328 to $0.99 per token. Meanwhile, toward the end of writing this article at 4:00 p.m. (ET), UST has been trying to regain the $1 parity but has yet to accomplish the goal. At press time at 4:30 p.m., the stablecoin UST has managed to jump to $0.956017 per unit.

What do you think about the stablecoin UST dropping from its $1 parity on Monday? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

[ad_2]

Source link

RELATED POSTS

View all