Terra’s Debacle Exposed Major Flaws For The Entire Crypto Industry

May 15, 2022 | by olympieioncryptonews

[ad_1]

Terra’s debacle exposed major flaws for the entire crypto industry calling into question the real-world utility as well as the long-term viability of the algorithmic stablecoin so let’s read more today in our latest cryptocurrency news.

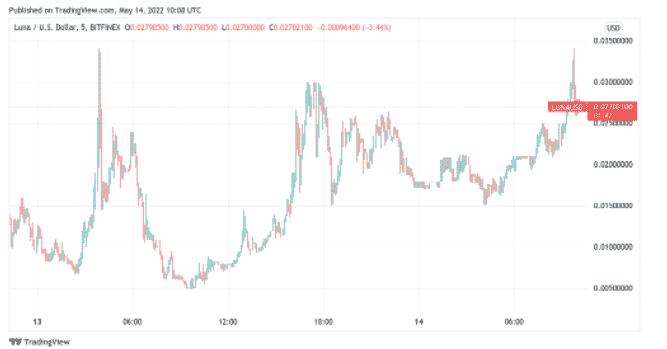

The past week was quite a dark period in the history of crypto with the total market cap of the industry dipping as low as $1.2 trillion so the turmoil has been due to the real-time disintegration of Terra which is a Cosmos-based protocol that powers a suite of algorithmic stablecoins. A week ago, Terra ranked among the 10 most valuable cryptocurrencies in the market with token trading at a price point of $85. May 11, the price of the asset dropped to $15 and then the token lost almost all of its value and traded to $0.00003465.

2/ I understand the last 72 hours have been extremely tough on all of you – know that I am resolved to work with every one of you to weather this crisis, and we will build our way out of this.

Together.

— Do Kwon 🌕 (@stablekwon) May 11, 2022

Due to Terra’s debacle, Terra’s other offering TerraUSD which is an algorithmic stablecoin pegged to the US dollar with a 1:1 ratio lost its peg to the dollar and is trading at $0.079527. the Terra protocol is driven by the use of two tokens, UST and LUNA so network participants are afforded the ability to mint UST by burning LUNA so one can envision the Terra economy as being one that consists of two pools, one for UST and one for LUNA. To maintain the UST value, the LUNA supply pool adds to or subtracts from the coffers like that client required to burn LUNA and mint UST. All of the reactions are incentivized by the algorithmic market module making UST’s functional framework to be different from rivals like Tether and USDC.

As soon as the coins went into freefall, the protocol’s co-founder released a new plan to revive the network. Kwon reinforced the burning of UST which failed to work initailly. He claimed that by increasing the base pool from 50 million to 100 million and decreasing the PoolRecoveryBlock from 36 to 18, the protocol’s minting capacity can be bumped from $293 million to $1.2 trillion. The Tera team got the chance to mint four times more UST out of thin air which was troubling for some analysts. One exactly believes that the general idea around the stabelcoin is quite flimsy because they lack actual backing assets.

Analysts believe that the entire episode will have a negative impact on the image of crypto and could result in lawmakers becoming more strict around decentralzied stablecoins. The event could even result in the survival of the best projects alone with many sketchy platforms losing investor interest.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

[ad_2]

Source link

RELATED POSTS

View all