[ad_1]

Terra’s trading volume surges 200% as the market adjusts to a death spiral and its insane volatility serves as an attractive market for short-term investors so let’s read more about it in today’s latest cryptocurrency news.

It took seven days for the LUNA ecosystem to spiral down as the prices came crashing from $85 to $0 in a few days but the market gained clarity on what happened and the trading volume of LUNA saw a steep recovery of 200% in a few days. As a result of the UST depegging that caused the LUNA market, the investors mirrored the price dip after the decline of trading volumes to $178 million which is a number last seen in February 2021.

A lot of noise on this, so let me comment.

For 59 minutes we were quoting prices 30-40x ABOVE market prices for Luna due to technical glitch that affected the retail app and NOT the exchange. https://t.co/XMjSnWQ6aO

— Kris | Crypto.com (@kris) May 13, 2022

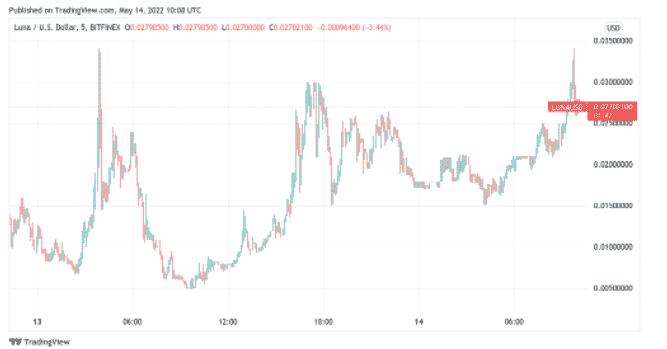

The Terraform Labs CEO and co-founder Do Kwon thought of plans to contrl the situation the same day he proposed the revival plan which involved compensating UST and LUNA holders for holding the tokens while the crash lasted. Despite all risks involved, the Terra insane volatility was an attractive market for most short-term investors because of the fact that LUNA gained 600% in value on May 14. the investors are trying to recoup their losses while others are trying to cash in on TErra’s comeback which is why LUNA soared by 200% back to $6 billion. Before the crash, the LUNA ecosystem recorded over $2 billion in trading volumes on average in the past two years.

When LUNA prices crashed between May 10 and May 13, the trading volume surged with investors trying to reduce their losses from $5 billion to $16 billion. Terra’s trading volume also recorded an ATH of $16.5 billion on May 11. due to the different factors, LUNA regained the tradign volume and now trades at $0.00025 and according to the data from CoinMarketCap, Binance represents 68.26% of the LUNA trading volume after KuCoin at 9.52% and FTX at 1.13%. Crypto.com unblocked the users and reversed the glitched trades. The CEO of the platform Kris Marszalek revealed that the internal error caused the system to display incorrect prices leading numerous investors to cash in 30-40x profits.

As a result, Crypto.com blocked all users from trading so, after a day’s review of the system glitch, Marszalek informed that the user accounts were re-enabled.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

[ad_2]

Source link