[ad_1]

Bitcoin’s price has been trading between a high of around $51,600 to a low of around $46,000 in the last week. On-chain data has also been showing a “general lack of activity” since entering 2022. Despite this, the Bitcoin market has some bullish undertones in its supply dynamics according to the latest edition of Glassnode’s the Week On-Chain report.

The report noted several on-chain metrics that point to a balance between bullish and bearish Bitcoin market signals, indicating that the Bitcoin market is currently consolidating somewhere in between the two.

Read More: Crypto Becomes Legal In India, Here’s All You Need to Know

Bitcoin Might be on the Verge of a Bull Run

The report goes on to compare the present trend of daily activities in the Bitcoin blockchain to other years and concludes that Bitcoin in 2022 bears a lot of similarities with 2019 rather than the bull run of 2017 or 2020-2021.

For one, daily activity has been on an increase as active on-chain entities have broken above the 275,000 per day level. Their data showed that the 2017 and 2020-2021 Bitcoin bull runs were marked by more activity on-chain. However, the market so far in 2022 bears more similarity with the mini bill market that occurred in April to August 2019 as they both follow a deep correction and capitulation event.

Another similarity between the current market and 2019 can be seen in the transaction count. The Bitcoin bull market of 2017 and 2020-21 was marked by a surge in transactions, hitting over 300,000 transactions per day at its peak. But at present, the market was more similar to 2019 as a burst in the transaction count supported a price rally, “but failed to sustain a meaningful momentum” as both prices and transaction counts fell.

These similarities between the two years led the analyst to conclude that until on-chain activity can show increased block space demand, Bitcoin’s price is expected to continue trading sideways.

Until there is further expansion in demand for Bitcoin blockspace, it can be reasonably expected that price action will be somewhat uneventful, and likely sideways at a macro scale.

Why supply dynamics remain bullish

While the market seems bearish at present, the bullish undertones in the market can be seen in the number of new wallets with a non-zero balance. This metric has been on the increase. Over the past year, it has grown 23.2% as 1.415 million non-zero Bitcoin wallet addresses were added, indicating that the user base of Bitcoin has increased over time.

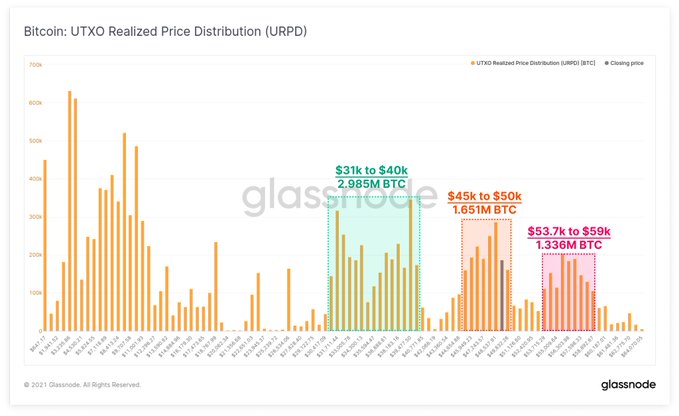

Similarly, supply dynamics in the market point to the fact that the market is being dominated by smart money institutional investors and patient long-term holders. The report notes that on-chain activity indicates that long-term holders (LTHs) dominating the market was impressive and highly bullish for Bitcoin price in 2022 especially as 2021 was endemic with price volatility.

Disclaimer

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

[ad_2]

Source link