[ad_1]

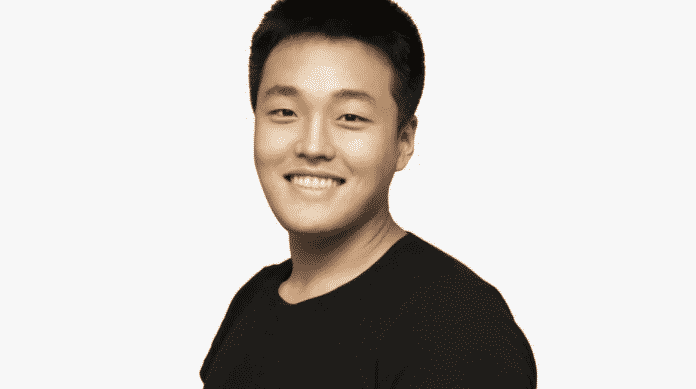

Do Kwon denies claims of cashing out $2.7 billion for the LUNA/USD collapse and said these rumors were categorically false so let’s read more today in our latest Cryptocurrency news.

The founder and CEO of Terra, Do Kwon denies claims of cashing out $2.7 billion before the fiasco which led to the UST losing the peg and LUNA crashing to $0. Twitter user FAtManTerra made another allegation a day ago, arguing that Do Kwon cashed out $2.7 billion over the span of a few months before UST’s depeg in May. FatMan alleged that Kwon used Degenbox to allow users to stake collateral to buy UST and put it into Anchor which was used for the staked UST to borrow more UST and put it in Anchor once gain. Hours later, Kwon refuted the claims and clammed them as categorically false:

“This should be obvious, but the claim that I cashed out $2.7B from anything is categorically false.”

Caught. The ‘mystery’ wallet with a 20M LUNA airdrop that was voting on Do’s own proposal, delegating to North Star, insider trading ASTRO, etc. – it is officially confirmed that it belongs to Do Kwon himself. (1/3) pic.twitter.com/QqfBnk6Oxe

— FatMan (@FatManTerra) June 12, 2022

He also said that for the past two years, the only thing that he earned is a cash salary from TFL and deferred taking most of the founder tokens because he didn’t need it and he didn’t want to cause unnecessary finger-pointing that he has too many coins. FatMan didn’t stop here and insisted on the founder’s wrongdoings asking more questions that are yet to be answered.

As recently reported, The appeal filed on behalf of Terraform Labs CEO Do Kwon was overruled on June 8 by a US court which stated that he and his company have to comply with investigations by the US SEC into the company’s Mirror Protocol. The latest development in legal tensions between Kwon and the SEC only affirms the ruling from February that both Kwon and his company have to hand over documents related to the Mirror Protocol and provide testimony to the SEC.

Mirror Protocol is a decentralized finance platform that is built on Terra and enables users to exchange synthetic versions of stocks like Apple, Tesla, and more. Kwon’s appeal was filed on the basis that the SEC violated rules when he delivered the subpoena at the Messari Mainnet conference back in 2021.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

[ad_2]

Source link