[ad_1]

Almost all 100 cryptos sink as LUNA reaches a bottom from $118 to zero in a month so let’s read more today in our latest cryptocurrency news.

Taking a short glance over the news recently can give you an idea of how the market is in a panic mode. Crypto’s craziest week saw $200 billion of the total marekt cap evaporate and while the industry leaders like BTC and ETH crashed to new lows not seen since 2020, they put institutional whales like Musk and Michael Saylor back underwater. According to other analysts, however, we haven’t reached the bottom yet.

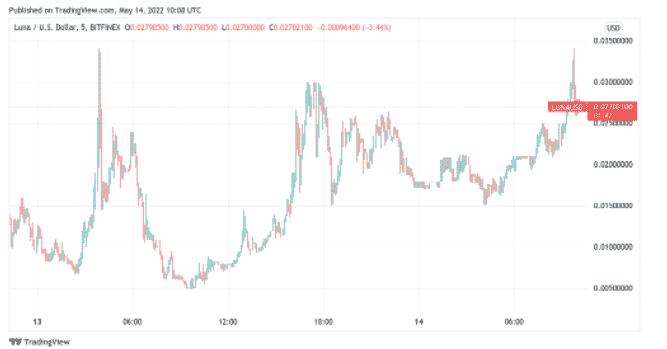

Terra’s leading crypto LUNA was once in the top 10 coins but not It fell to zero. LUNA posted an ATH of $118 and it is now trading for a fraction of a penny. LUNA’s demise was driven by the collapse of TErra’s UST dollar-pegged coin which bottomed out at 13 cents and it increased a little today to 19 cents. It is now the sixth consecutive week of the market decline as virtually almost all 100 cryptos sank with losses of double-digit percentages. BTC is down 20% from last week and traded at $28,809 and ETH dropped by 27%.

Among the biggest losers are Cosmos which sank by 43%, Algorand also by 43%, NEAR by 43%, and Polygon by 40%. the only top 100 coin which gained momentum was Maker which increased by 7.1%. aside from tErra’s crash, the news cycle carried on for the past few weeks and enhanced the talks of stablecoin regulation. Instagram announced it will test NFT connectivity with a few US-based collectors and creators. The pilot allows testers to link crypto wallets to their accounts and to show verified collectibles. The parent company Meta also said Facebook NFT support is expected soon.

The economist Nouriel Roubini started working on an inflation-proof dollar-pegged stablecoin and his Atlas Capital tapped Andreessen Horowitz-backed Mysten Labs to develop tech for the United Sovereign Governance Gold Optimized dollar. The project is a huge turn-around for Roubini who in 2018 called crypto “the Mother of all scams.” Also, the president of El Salvador announced a new purchase of 500 BTC at around $15.3 million which took the total stash of the country to around $66 million or 2300 BTC.

Treasury secretary Janet Yellen outlined Terra’s collapse as an example of why stablecoins have to be regulated and she mentioned crypto to say that the industry’s $1.23 trillion market cap poses no risks to the US financial system but they are growing so fast and present the same risks that we know from bank runs. The US SEC Chair Gary Gensler leveled some sharp criticism at crypto exchanges and stablecoins in an interview saying that many exchanges run custody and market-making without separating them as traditional exchanges that are required to so Gensler accused them of trading against their customers because they are market-making against their customers.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

[ad_2]

Source link