[ad_1]

Key Takeaways

- The number of short Bitcoin positions has surged on Bitfinex.

- Such market behavior has coincided with downward price action in the past.

- Further selling pressure could push BTC below $34,400, triggering a capitulation event.

Share this article

Bitcoin has looked shaky for weeks, with many large investors favoring the downside. The increasing downward pressure could push BTC to break support and suffer a steep correction.

Bitcoin Spells Trouble

Bitcoin continues to trade sideways while large investors appear to be betting on an upcoming capitulation event.

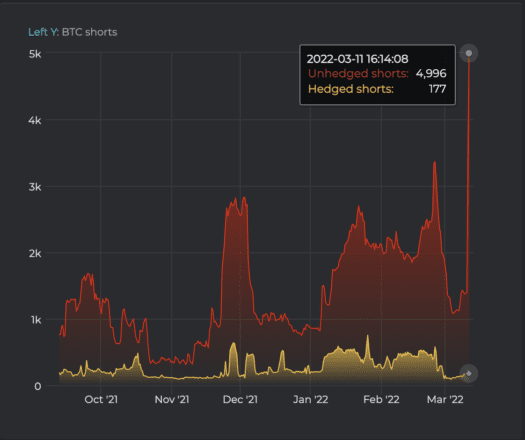

Data from Datamish shows that there has been a significant increase in the number of short Bitcoin positions taken out on Bitfinex. It appears that a group of large investors or institutions borrowed roughly 1,500 Bitcoin worth $58.5 million from the Hong-Kong based cryptocurrency exchange with the expectation that prices will decrease in the near future.

A total of 4,982 Bitcoin have been lent on the exchange, and most of the short positions are non-hedging at the time of writing.

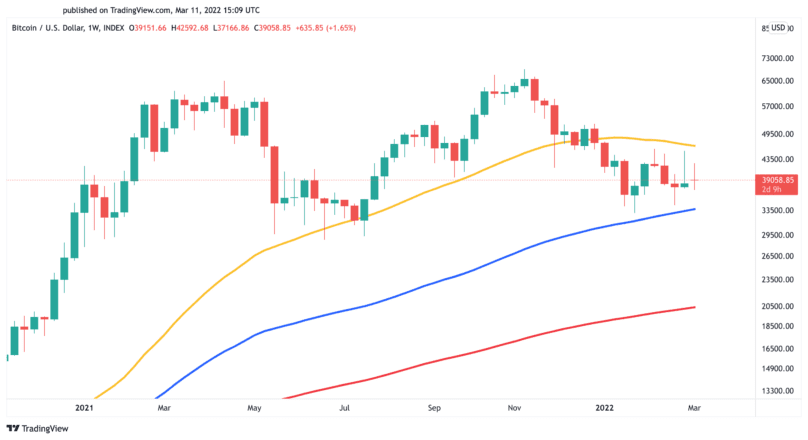

The sudden spike in short positions comes as Bitcoin faces consistent rejection from the 50-week moving average after weeks of testing the critical resistance barrier. Still, the top cryptocurrency appears to hold above a vital support area represented by the 100-week moving average at $34,400. A decisive close below this demand level could lead to a downturn for Bitcoin.

Based on the weekly chart, a decisive candlestick close below the 100-week moving average at $34,400 could have the potential to ignite panic selling among market participants. If this were to happen, Bitcoin would likely capitulate toward the 200-week moving average at around $20,000 to begin forming a market bottom.

The respected on-chain analyst Willy Woo has also said that he thinks that institutions and large holders have not stopped selling Bitcoin. He stated that a price crash could be imminent given that Bitcoin has historically endured capitulation events in previous bull markets. In a Mar. 10 Substack post, he wrote:

“There’s no question we are in a bear market due to the duration of the sell-off. There’s never been a bottom of a bear market in BTC without a capitulation event, so I think there is a high probability that this region breaks down, and we test lower lows before accumulation takes place to set up for the next bull cycle,” said Woo.

Bitcoin is currently trading at around $38,850. It’s about 43.4% short of its all-time high.

Disclosure: At the time of writing, the author of this piece owned BTC and ETH.

Share this article

U.K. Watchdog Orders Bitcoin ATMs to Shut Down

The Financial Conduct Authority has ordered all crypto ATMs in the United Kingdom to shut down. U.K. Crypto ATMs Forced to Close The FCA has declared that all operational crypto…

[ad_2]

Source link