[ad_1]

The world’s largest crypto exchange Binance on Friday said it is listing new USD-M and COIN-M quarterly 0927 delivery contracts on Binance Futures. The delivery contracts will support only top cryptocurrencies including Bitcoin (BTC), Ethereum (ETH), BNB, XRP, Cardano (ADA), Chainlink (LINK) and others.

The crypto exchange is also extending the Futures Ultimate Challenge comprising of Daily BTC Price Prediction and Weekly Tesla Challenge for Binance Futures users. These are part of Binance’s strategy to maintain liquidity on the crypto exchange and ensure smooth market functions.

Binance Listing BTC, ETH, ADA, XRP Futures Contracts

According to an official announcement on March 22, Binance revealed listing USD-M and COIN-M Quarterly 0927 Delivery Contracts. Users can start trading these contracts from 08:00 UTC on March 29.

BTCUSDT Quarterly 0927 and ETHUSDT Quarterly 0927 delivery contracts will be settled in USDT. Binance will offer max leverage of 50x on both futures delivery contracts.

Meanwhile, COIN-M delivery contracts will support BTC, ETH, BNB, ADA, LINK, BCH, XRP, DOT & LTC. Max leverage on BTC and ETH is 50x and 20x for others crypto.

“Users are only allowed to close their positions or place Reduce Only orders and are not allowed to open any new positions ten minutes prior to delivery,” as per the announcement.

Also Read: Ripple CEO and CLO Backs Ethereum and CFTC, Say US SEC to Lose

Binance BTC Price Prediction and Tesla Challenge

Binance Futures extends the Futures Ultimate Challenge due to popular demand among crypto investors. The Daily BTC Price Prediction and Weekly Tesla Challenge starts at 14:00 UTC on March 24 and ends on April 21 at 13:59 UTC.

Binance offers 0.05 BTC token voucher for predicting the mark price of BTCUDT perpetual contract. Meanwhile, users get Golden Tickets and a chance to win Tesla Model Y each week until the promotion ends. The exchange grabs major trading volumes from promotions like these, especially zero-fee trading.

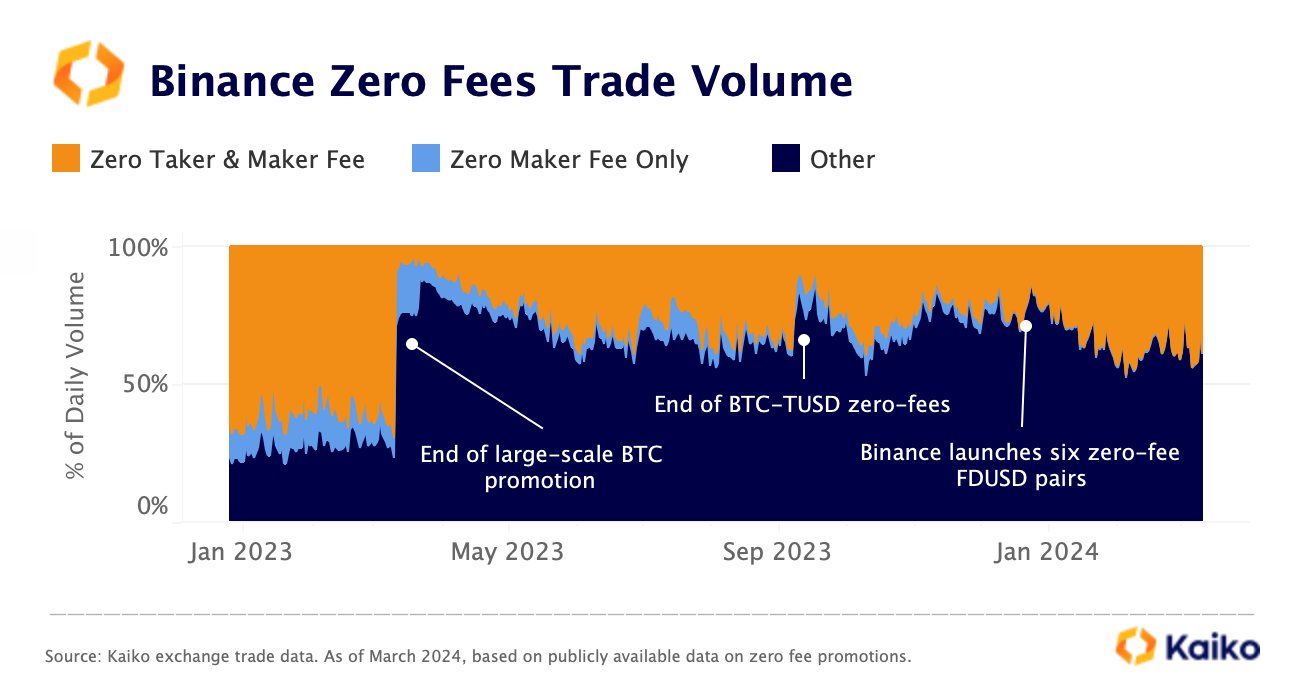

Kaiko revealed the exchange relies heavily on zero-fee trading. The zero-fee volume share has recently hit 40%, highest level since last March.

Moreover, FDUSD is the second-largest stablecoin by trade volume on crypto exchanges and it only trades on Binance. The zero-fee trading on FDUSD pairs has majorly brought a large number of users on Binance.

Also Read: BTC and ETH Options Worth $2.6B Set to Expire, Bitcoin Traders Buying Calls for $76K

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

[ad_2]

Source link