[ad_1]

Key Takeaways

- Bitcoin has gained 7,000 points in market value over the past ten days.

- The top crypto asset has now entered a significant resistance zone.

- A decisive close above $45,500 could catapult Bitcoin to $51,000.

Share this article

Bitcoin has reached a crucial resistance area after surging by nearly 19% over the past 10 days. However, it remains to be seen whether the top cryptocurrency will have the strength to slice through it to resume its uptrend.

Bitcoin Tests Resistance Again

Bitcoin is once again threatening to break out.

The leading cryptocurrency continues to trend up, gaining over 7,000 points in market value in the past 10 days. It’s broken above $45,000 for the first time since Feb. 10, trading at $45,013 at press time. Increased buying pressure from the likes of the Luna Foundation Guard, which is currently accumulating Bitcoin in order to increase Terra’s UST reserves, and renewed confidence among market participants have helped Bitcoin flourish this week.

Several on-chain metrics have hinted that a trend reversal could soon play out. However, Bitcoin must first break through the $45,500 resistance zone to be able to advance further.

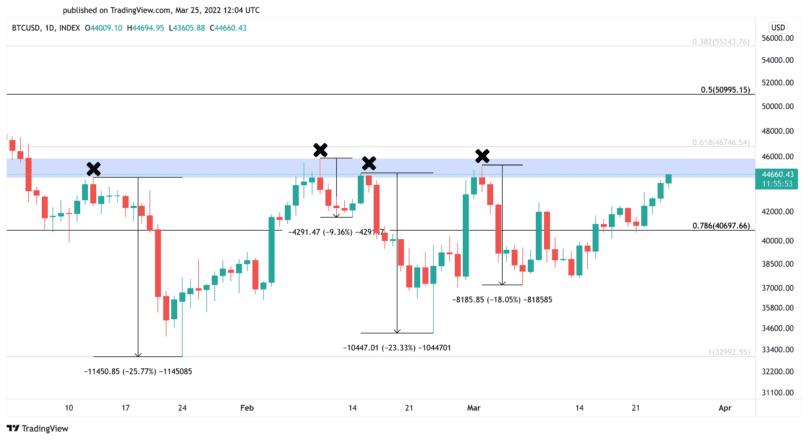

The top crypto’s trading history shows that this hurdle has been challenging to break. Every time Bitcoin has tested the $45,500 resistance area since the beginning of the year, it has failed to break it and posted a significant retrace. For instance, when it was rejected from the key level in mid-January, mid-February, and early March, it shed losses of over 18%.

While Bitcoin is attempting to overcome resistance again, traders appear skeptical.

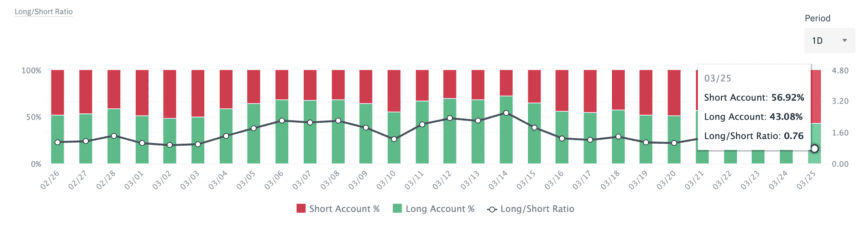

Transaction data from Binance Futures shows that the BTCUSDT Long/Short Ratio has declined to a 0.76 ratio as of Mar. 25. Such market behavior indicates that roughly 57% of all trading accounts on the platform are net-short on Bitcoin.

The high levels of pessimism surrounding Bitcoin’s future price performance may act as a warning signal that a short squeeze is underway.

A spike in upward pressure that pushes Bitcoin beyond the $45,500 resistance zone could trigger a cascade of liquidation in the futures market, catapulting prices higher. The Fibonacci retracement indicator, measured from the November all-time high at nearly $70,000 to the late January low at $33,000, suggests that Bitcoin could target $51,000 if it successfully overcomes resistance. However, failing to breach such a crucial supply wall could result in a pullback to $40,700.

Disclosure: At the time of writing, the author of this piece owned BTC and ETH.

Share this article

Terra’s Bitcoin Spree Could Help LUNA Moon

The Luna Foundation Guard (LFG) recently announced plans to accumulate billions of dollars worth of Bitcoin to stabilize UST. Terra’s LUNA now looks primed for new highs, but it must…

[ad_2]

Source link