[ad_1]

Key Takeaways

- Bitcoin has dipped below $40,000, and many other assets have also declined.

- Macroeconomic factors such as the Federal Reserve’s planned interest rate hikes and ongoing Russia-Ukraine tensions have impacted global markets over the last few weeks.

- While major crypto assets look shaky, top-tier avatar NFTs appear to be in their own bull trend.

Share this article

Other lower cap assets were harder hit as Bitcoin tumbled Friday.

Bitcoin Trades Below $40,000

Bitcoin is trading in the red again.

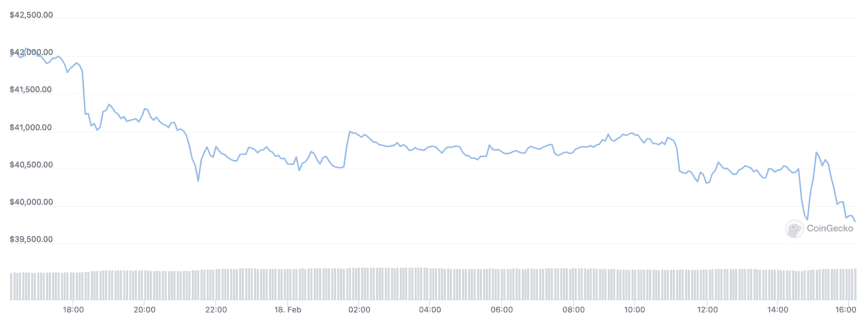

The number one crypto asset dipped below $40,000 Friday amid uncertainty across global markets. It’s down 4.6% today, trading at roughly $39,700 at press time.

Ethereum, Solana, and many other assets suffered harder from the downturn. Ethereum is down 5.3% today, while Solana, Avalanche, and Terra, three Layer 1 chains often touted as Ethereum competitors, have tanked 5.9%, 7.8%, and 8.1%. The Metaverse tokens Decentraland and The Sandbox also declined alongside two of DeFi’s most established projects, Aave and Curve.

The latest dip follows weeks of rocky price action in the crypto market. While Bitcoin and other assets have occasionally shown bullish momentum, most assets are trading significantly down from their record highs. Bitcoin is 42% short of the $69,000 level it breached on Nov. 10, and Ethereum is 42.2% down from when it topped $4,800 on the same day. Solana is 64.9% down from its high, and many lower cap assets have fared even worse. Dogecoin, for instance, is trading 81.1% below its all-time high. The latest plunge puts the global crypto market cap at about $1.9 trillion, down over 36.6% from its $3 trillion peak.

Several major macroeconomic events have impacted crypto in recent weeks. In December, the market fell on fears of the Omicron variant, before news of the Federal Reserve’s planned interest rate hikes caused another downswing. The market has experienced volatility around the Fed’s more recent meets, with a first hike currently expected next month. The Biden Administration, meanwhile, is confirmed to issue an Executive Order on regulating cryptocurrencies next week, and ongoing tensions over a possible Russia-Ukraine conflict have also affected the market’s sentiment. Outside of crypto, the S&P 500, Dow Jones, and Nasdaq-100 are also respectively down 0.41%, 0.3%, and 0.82% today.

While Bitcoin and most of the crypto market has had a rocky few weeks, some assets are defying the trend. The NFT market has shown low correlation with fungible crypto assets in recent weeks, with many top-tier NFTs trending up even as major assets struggle to make new highs. The floor price for Bored Ape Yacht Club NFTs topped 100 ETH for the first time last month, while other sought-after avatar-based collections like Azuki and mfers have soared. Even as Ethereum trades below its all-time high, dedicated NFT collectors are betting that 2022 could prove to be another big year for the red hot asset class.

Disclosure: At the time of writing, the author of this feature owned ETH, CRV, AAVE, and several other cryptocurrencies.

Share this article

JPMorgan Thinks Bitcoin Is Overvalued at $44,000

Analysts at JPMorgan Chase have estimated that the “fair value” for Bitcoin is $38,000, suggesting that the asset is overvalued by around 12%. JPMorgan Shares Bitcoin Valuation Models Despite its…

[ad_2]

Source link