Bitcoin Bullish Fundamentals Wanes Ahead Of FOMC; Wall Street Estimates

March 21, 2023 | by olympieioncryptonews

[ad_1]

Bitcoin price holds above $28,000 as traders speculate whether more upside momentum still exists. Investors are awaiting the crucial rate hike decision by the U.S. Federal Reserve after the FOMC meeting on Wednesday amid the banking crisis in the U.S.

The CME FedWatch Tool indicates there’s an 18.1% probability of no rate hike by the Fed and an 81.9% probability for a 25 bps rate hike. Moreover, the Crypto Fear & Greed Index has hit a 16-month high of 68, with the market sentiment currently in the ‘Greed‘ zone.

Bitcoin Fundamentals Shifting Ahead of FOMC

Massive Bitcoin rally in the last two weeks pushed BTC price to hit over $28,000 after 9 months. However, the fundamentals are changing ahead of the FOMC rate hike decision.

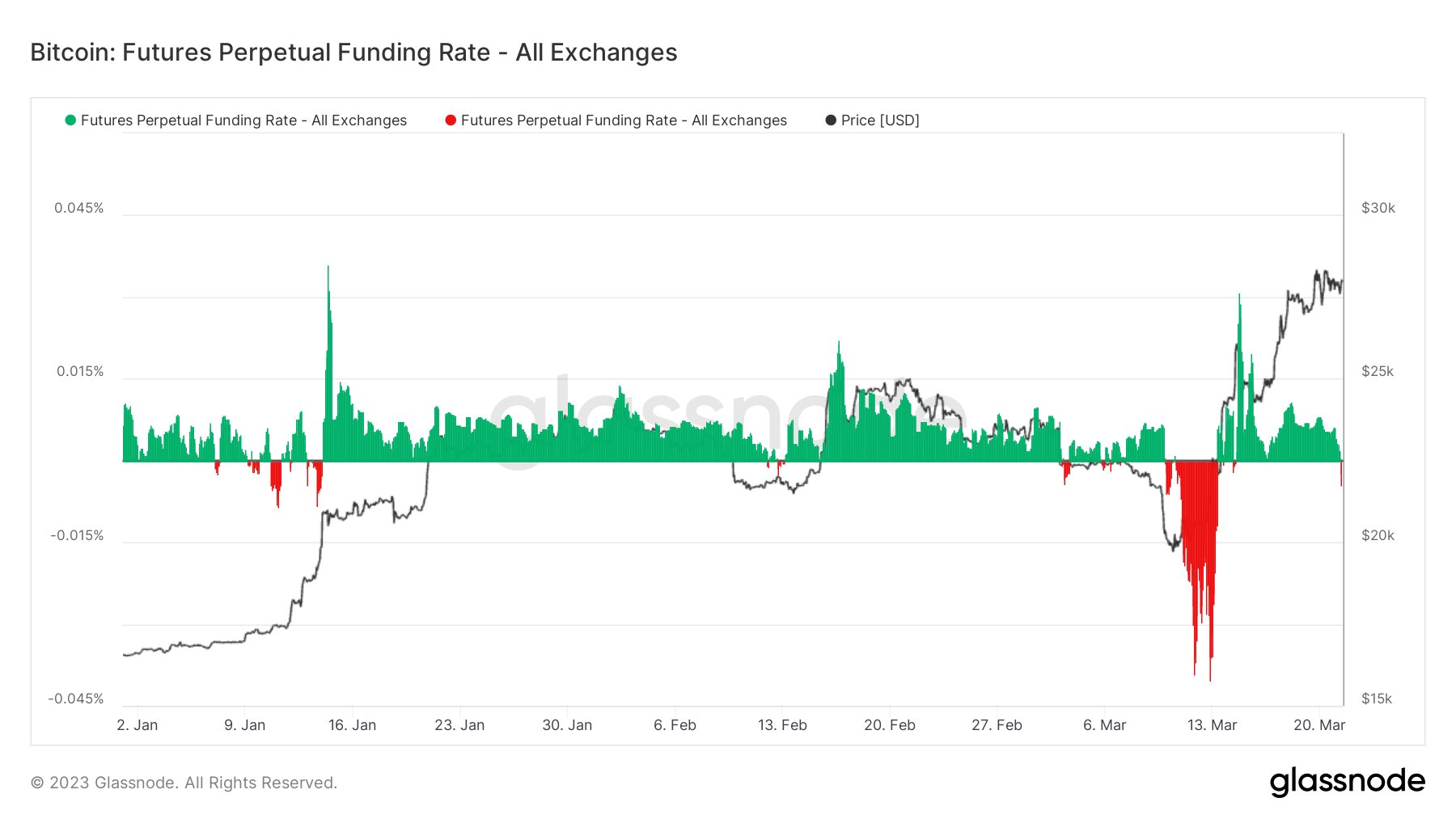

Bitcoin futures perpetual funding rate just turned negative for the first time in a week as traders speculate whether a correction is coming next. Bearish sentiment ahead of the crucial FOMC rate hike will likely cause Bitcoin price to fall below $27,000 again.

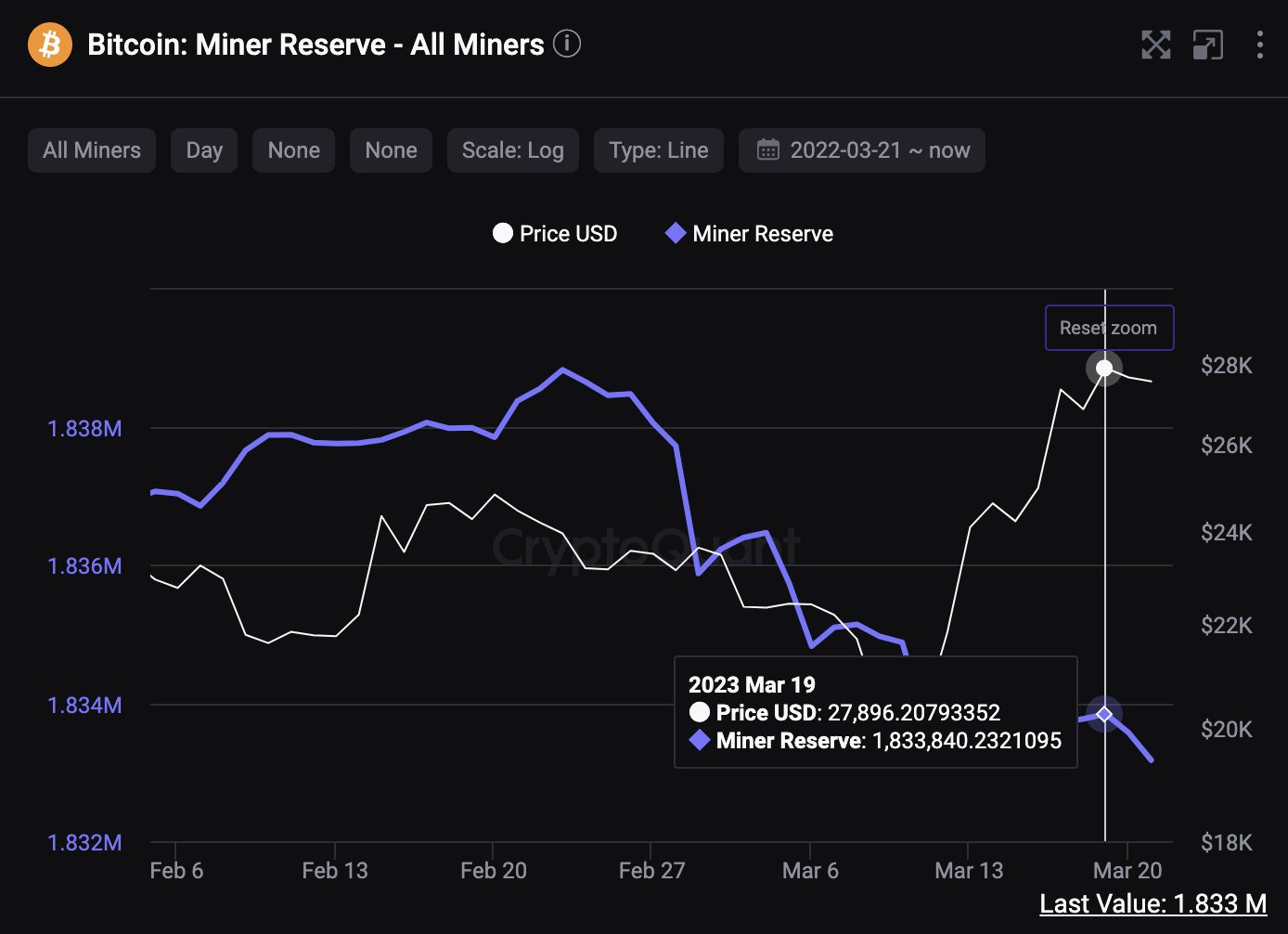

Meanwhile, the dump on BTC dominance is creating a spike in altcoins, with Ethereum and XRP jumping 3% and 5% in just an hour, respectively. Moreover, miner reserves dropped by 668 BTC in the last 48 hours, which suggests that miners have sold around $18,370,000 worth of BTC.

Wall Street Estimates On Fed Rate Hike

Tesla CEO Elon Musk, economist Peter Schiff, and billionaire Bill Ackman have warned the U.S. Fed and FDIC of worsening banking crisis and market conditions if the central bank decides to continue rate hikes. Bill Ackman believes the Fed should pause, while Elon Musk replied “Fed needs to drop the rate by at least 50bps on Wednesday.”

For the first time in many years, Wall Street giants have given mixed estimates on the Fed rate hike. Barclays, Credit Suisse, and Goldman Sachs no longer expect the Fed to hike rates in March. Meanwhile, Bloomberg, JP Morgan, Morgan Stanley, BMO, and Citi estimate a 25 bps rate hike.

Also Read: LUNC News: Developer Edward Kim Hints At Terra Luna Classic Becoming AI Chain

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

[ad_2]

Source link

RELATED POSTS

View all