[ad_1]

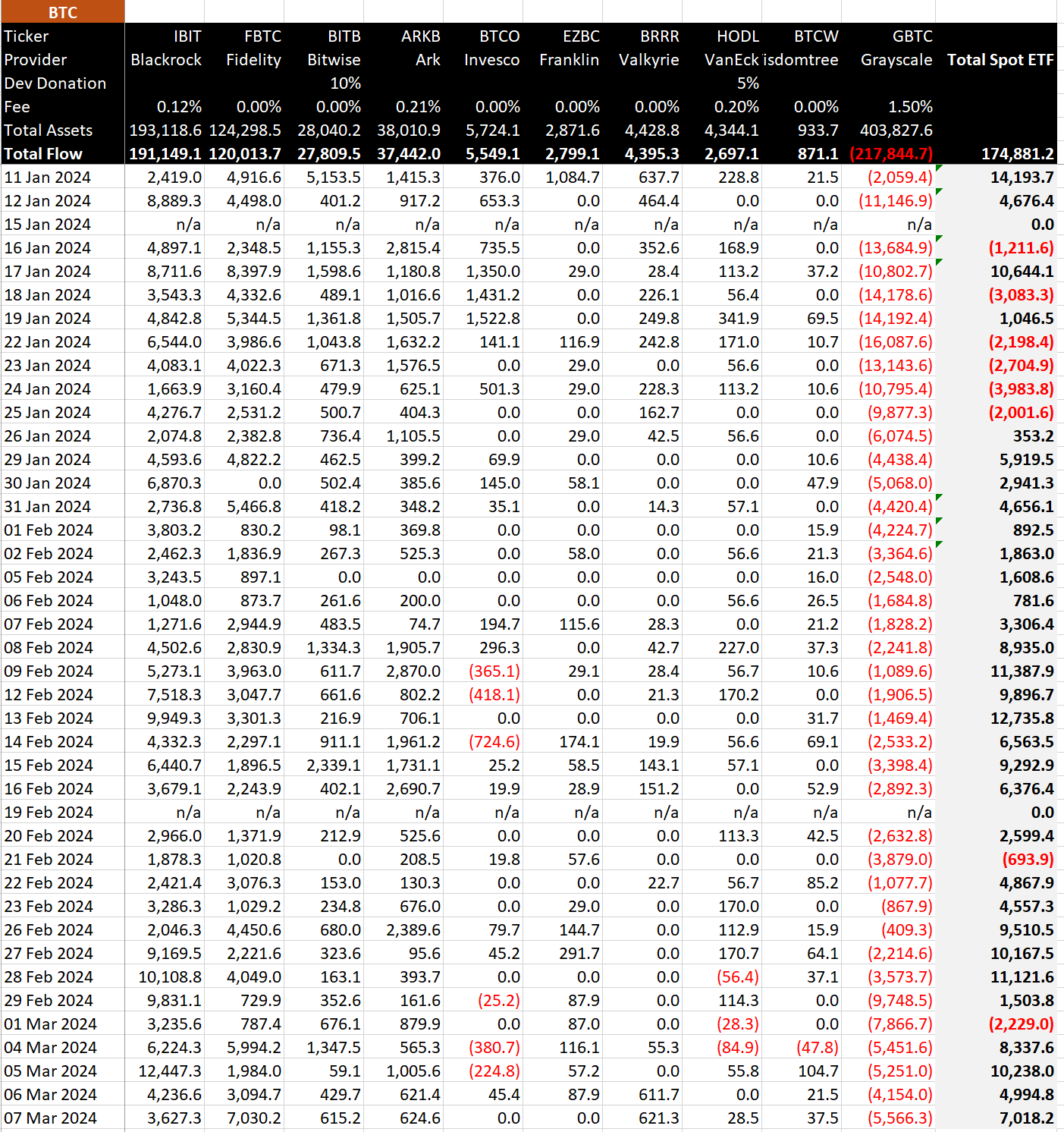

The U.S. Spot Bitcoin ETF market remains a hotspot for investors, accumulating a staggering around 175,000 BTC since its launch despite Grayscale’s heavy outflow. Notably, the Bitcoin ETFs also continued their robust momentum this week, while Fidelity FBTC recorded its highest inflow on March 7 since its launch. However, the latest data also suggests that the BlackRock influx has cooled this week, sparking curiosity among investors.

U.S. Bitcoin ETF Accumulates 175K BTC

Since the inception of the U.S. Spot Bitcoin ETF, investor interest has skyrocketed, with total inflows reaching $9.36 billion, equivalent to 174,881.2 BTC. On March 7 alone, these ETFs accumulated 7,018.2 BTC, underscoring the growing demand for Bitcoin investment instruments.

Meanwhile, Fidelity’s FBTC led the pack, which attracted a whopping $473.4 million inflow or 7,030.2 BTC, followed by BlackRock’s $244.2 million influx or 3,627.3 BTC on March 7. However, while Fidelity’s inflow surged, BlackRock’s IBIT experienced a cooling trend.

In contrast, Grayscale’s GBTC faced significant outflows, recording $374.8 million on the same day. Since the launch of the U.S. Spot BTC ETFs in January 2024, Grayscale’s total outflux has hit $10.25 billion or 217,844.7 BTC.

Commenting on this surge, James Butterfill, CoinShares’ Head of Research, highlighted the relentless momentum, stating, “US Bitcoin ETF Issuers are not showing any signs of inflows slowing down.” This sentiment reflects the bullish outlook of investors towards Spot Bitcoin ETFs and the broader digital asset market.

Also Read: Blur, Sei, and Uniswap Prices Likely to Rally Next Week, Here’s Why

Global Digital Asset Sector Witnesses Remarkable Growth

The Bitcoin ETF has fuelled confidence of the investors in the digital asset sector. Notably, beyond BTC ETFs, the global digital asset sector is experiencing a remarkable surge in investments.

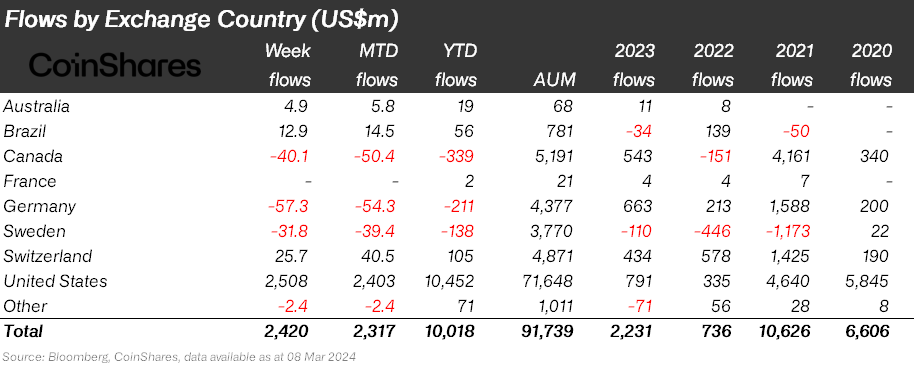

James Butterfill shared insights, revealing a total fund flow exceeding $10 billion year-to-date (YTD) in the Digital Asset sector as of March 7, nearing the $10.6 billion mark observed in 2021.

The United States emerges as a key player in this surge, with a significant inflow of $10.45 billion in 2024, compared to just $4.64 billion in 2021. This exponential growth underscores the increasing confidence of investors in digital assets and their potential for long-term value appreciation.

Also Read: Solana Co-founder Praises Brian Armstrong Over Coinbase’s Hiring Policy

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

[ad_2]

Source link