[ad_1]

In a recent report, BitMEX Research has unveiled the flow data of the U.S. Spot Bitcoin ETFs since their launch, revealing a notable net inflow of over 32,000 BTC within just 17 trading days. Notably, this surge, valued at approximately US$1.459 billion, has sparked a dynamic shift in the market dynamics, especially as whale wallets exhibit significant movement.

So, let’s delve into the intricacies of these market dynamics and their potential impact.

Bitcoin ETFs Notes 32,000 BTC Inflow Amid Whale Wallets’ Move

BitMEX Research’s latest findings showcase a reshaping of the market landscape with the U.S. Spot Bitcoin ETF leading the charge. According to the report, the total inflow into Spot Bitcoin ETFs was 32,002.7 BTC, worth $1.459 billion, since their launch.

Meanwhile, Grayscale GBTC experienced a net outflow of 143,559.4 BTC, equivalent to approximately US$5.967 billion, while other nine ETFs witnessed a net inflow of 175,562.2 BTC, offsetting the Grayscale’s outflow. Notably, BlackRock IBIT emerged as the frontrunner, boasting a net inflow of 72,411.9 BTC, followed closely by Fidelity FBTC with a net inflow of 58,877.6 BTC.

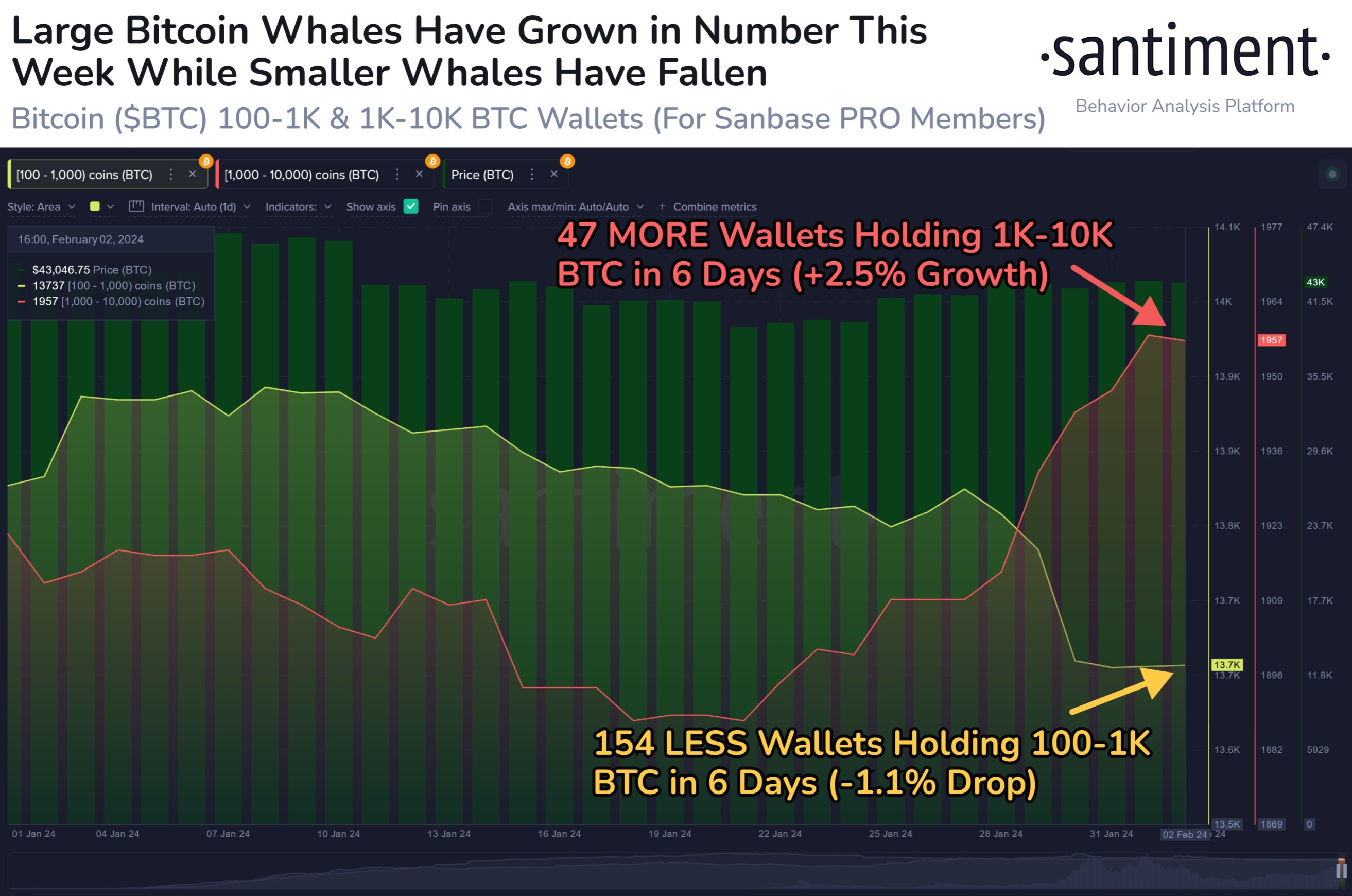

On the other hand, on-chain data provider Santiment adds another layer to the unfolding narrative, revealing substantial activity among whale wallets despite Bitcoin’s range-bound price between $41,000 and $44,000. According to the update, the number of 1K-10K BTC wallets surged to 1,958 on February 1, the highest since November 2022, while wallets containing 100-1K BTC hit a low of 13,735, the least since the same period.

Meanwhile, Santiment’s data signals potential market volatility as whales strategically position themselves amidst the ongoing price consolidation, influencing sentiment and trading patterns.

Also Read: Shardeum (SHM) Airdrop- Tokenomics, Eligibility, & Everything Else To Know

Bitcoin To Dominate Gold & Real Estate?

In a recent X post, renowned crypto analyst PlanB shared a bold prediction for Bitcoin’s future scarcity, comparing it to gold and real estate. PlanB contends that, following the April Bitcoin halving, BTC’s scarcity will surpass that of gold and real estate, potentially leading to a market cap exceeding $10 trillion.

With the current Bitcoin market cap standing at less than $1 trillion, this projection implies a potential Bitcoin price surge to over $500,000. In addition, PlanB supports this forecast by referencing Stock-to-Flow (S2F) ratios, where Bitcoin’s S2F-ratio is estimated to be around 110, exceeding both gold (S2F-ratio ~60) and real estate (S2F-ratio ~100).

However, this optimistic outlook comes as Bitcoin Futures Open Interest (OI) experiences a decline, CoinGlass data showed. Despite a 1.21% drop in overall Bitcoin OI over the last 24 hours to 408.57K BTC or $17.53 billion, specific platforms like CME noted a slight decrease, while Binance observed a modest increase.

Meanwhile, the Bitcoin price hovered around the $43,000 mark with a 0.10% decline over the last 24 hours during writing. However, over the last seven days, BTC witnessed a surge of 3%, while losing about 4% in the last 30 days.

Notably, these insights on Spot Bitcoin ETF, PlanB’s prediction, and the concurrent shifts in Bitcoin Futures Open Interest highlight the ongoing discussions surrounding Bitcoin’s future potential and its evolving role as a store of value in the global financial ecosystem.

Also Read: Ripple Unveils Key Regulatory Vision For Decentralized Finance

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

[ad_2]

Source link