[ad_1]

Bitcoin garners investor attention amid market fluctuations, hinting at the potential price recovery of the flagship crypto. Notably, despite a recent dip to $65,000 from its $73,000 peak, Bitcoin’s resilience near this level sparks optimism. On the other hand, insights from prominent crypto analyst Ali Martinez further bolster investor confidence in Bitcoin’s outlook.

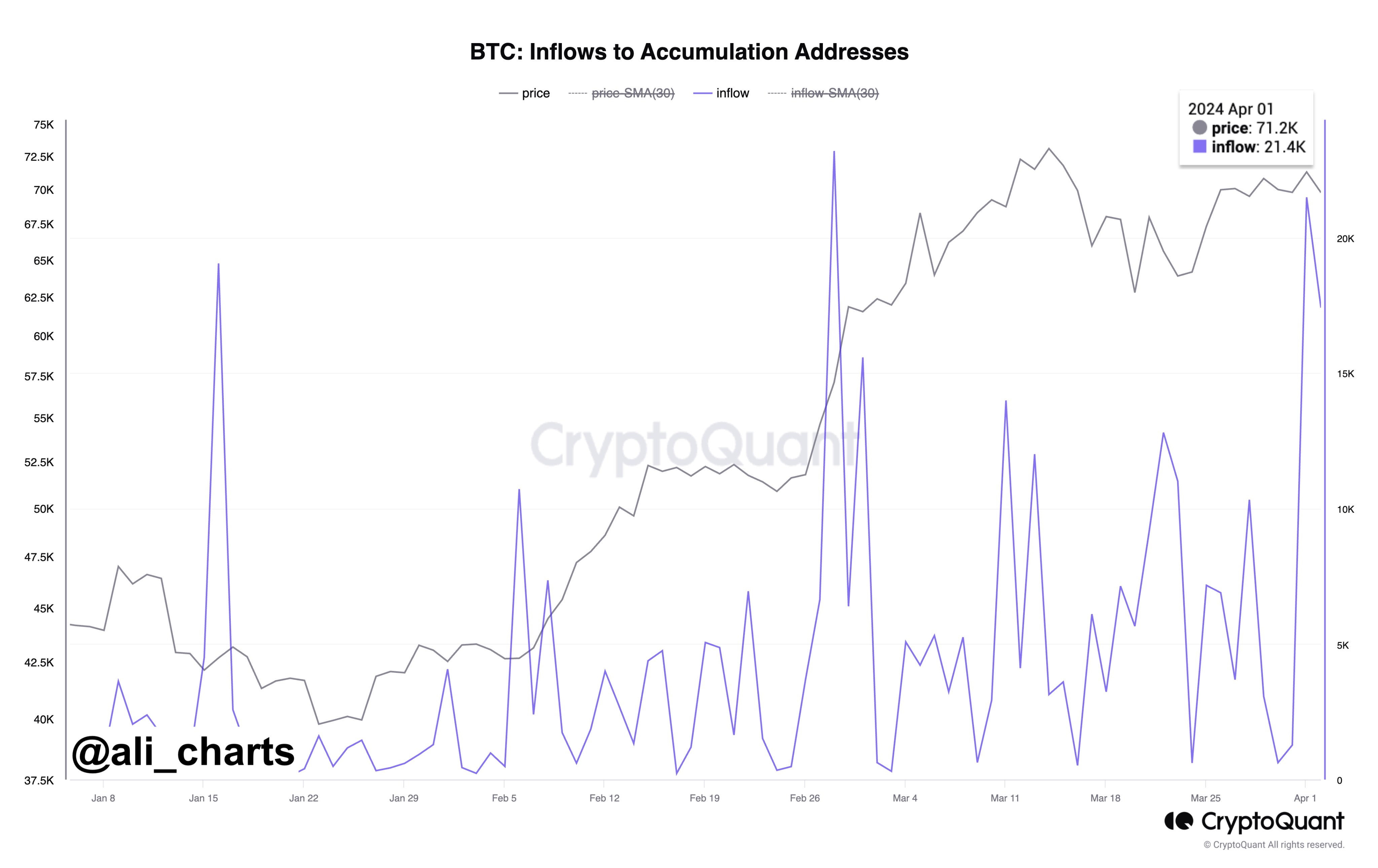

Bitcoin Accumulation Signals Bullish Momentum

The Bitcoin price has gone through a topsy-turvy momentum lately, as evidenced by the price performance of the cryptos. However, despite the recent dip in the BTC price, it seems that the traders are regaining confidence in the flagship crypto, signaling a potential recovery in the coming days,

Meanwhile, prominent crypto analyst Ali Martinez has injected a dose of optimism into the market with his recent observation regarding Bitcoin accumulation. Notably, Martinez highlighted a significant movement of 21,400 BTC, valued at approximately $1.40 billion, into accumulation addresses. This influx of Bitcoin to long-term holding addresses suggests growing confidence among investors and reflects a bullish sentiment toward the cryptocurrency.

In addition, Martinez has recently underlined Bitcoin’s correlation with the Nasdaq 100 index, indicating a potential price surge toward $90,000 in the near future. His insights have resonated with traders, instilling confidence in Bitcoin’s resilience and its ability to weather short-term market fluctuations.

Also Read: Lido’s Market Share on Ethereum Drops Under 30%, Thanks to Restaking Protocols

Market Dynamics and Future Outlook

While recent volatility in the Bitcoin market may have triggered uncertainty among investors, analysts remain largely bullish on the cryptocurrency’s long-term trajectory. Many attribute the recent correction to typical market fluctuations observed before the Bitcoin Halving event, a phenomenon historically followed by price rallies.

However, investors are advised to exercise caution and not solely rely on historical patterns to predict future performance. While Bitcoin’s resilience and the prospect of recovery are encouraging, market dynamics can shift rapidly, necessitating a prudent approach to investment decisions.

Meanwhile, as of writing, the Bitcoin price soared 0.22% and traded at $66,398.42, while its trading volume plunged 32.41% to $30.36 billion. Over the last 24 hours, the BTC price has touched a high of $66,914.32 and a low of $65,103.75, suggesting the heightened volatile scenario in the market.

Also Read: You Won’t Believe Who Tops The Solana Rich List, Unveiling Top SOL Holders

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

[ad_2]

Source link