Bitcoin Miners Face a Squeeze as BTC Production Cost Remains Well Above Spot Market Value – Mining Bitcoin News

November 21, 2022 | by olympieioncryptonews

[ad_1]

Bitcoin miners are dealing with lots of pressure following the recent difficulty adjustment increase on Nov. 20, 2022, and the leading crypto asset dropping further in value against the U.S. dollar following FTX’s collapse. Statistics recorded this past weekend show that bitcoin’s average cost of production has been a lot higher than bitcoin’s USD value recorded on spot market exchanges.

Statistics Show Bitcoin’s Cost of Production Is a Lot Higher Than the Leading Crypto Asset’s USD Value

On Sunday, Bitcoin.com reported on Bitcoin’s difficulty rising by 0.51% at block height 764,064, and the increase pushed the difficulty to an all-time high at 36.95 trillion. After that difficulty transition, data shows the overall global hashrate dropped from 317 exahash per second (EH/s) to 233 EH/s.

The hashrate is currently coasting along at 250.59 EH/s, according to records from coinwarz.com. At the same time, BTC’s fiat value dropped a great deal after FTX collapsed and filed for bankruptcy protection.

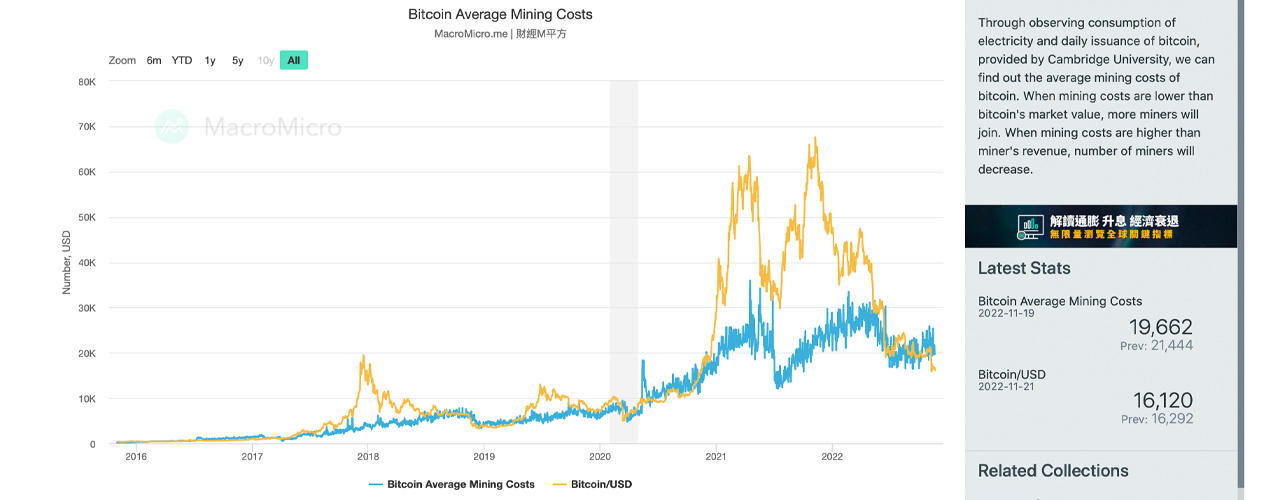

Statistics on Nov. 21, 2022, show that the cost of bitcoin production is much higher than BTC’s current USD spot market value. The metrics recorded by macromicro.me indicate that the average mining cost is $19,662 today, while the USD value of BTC is recorded at 16,120 nominal U.S. dollars per unit.

The macromicro.me statistics indicate that bitcoin’s price in comparison to the cost of BTC production has been lower since Oct. 6, 2022. Macromicro.me says that the web portal uses data collected from Cambridge University in order to “find out the average mining costs of bitcoin.”

“When mining costs are lower than bitcoin’s market value, more miners will join,” the macromicro.me website details. “When mining costs are higher than miner’s revenue, [the] number of miners will decrease.”

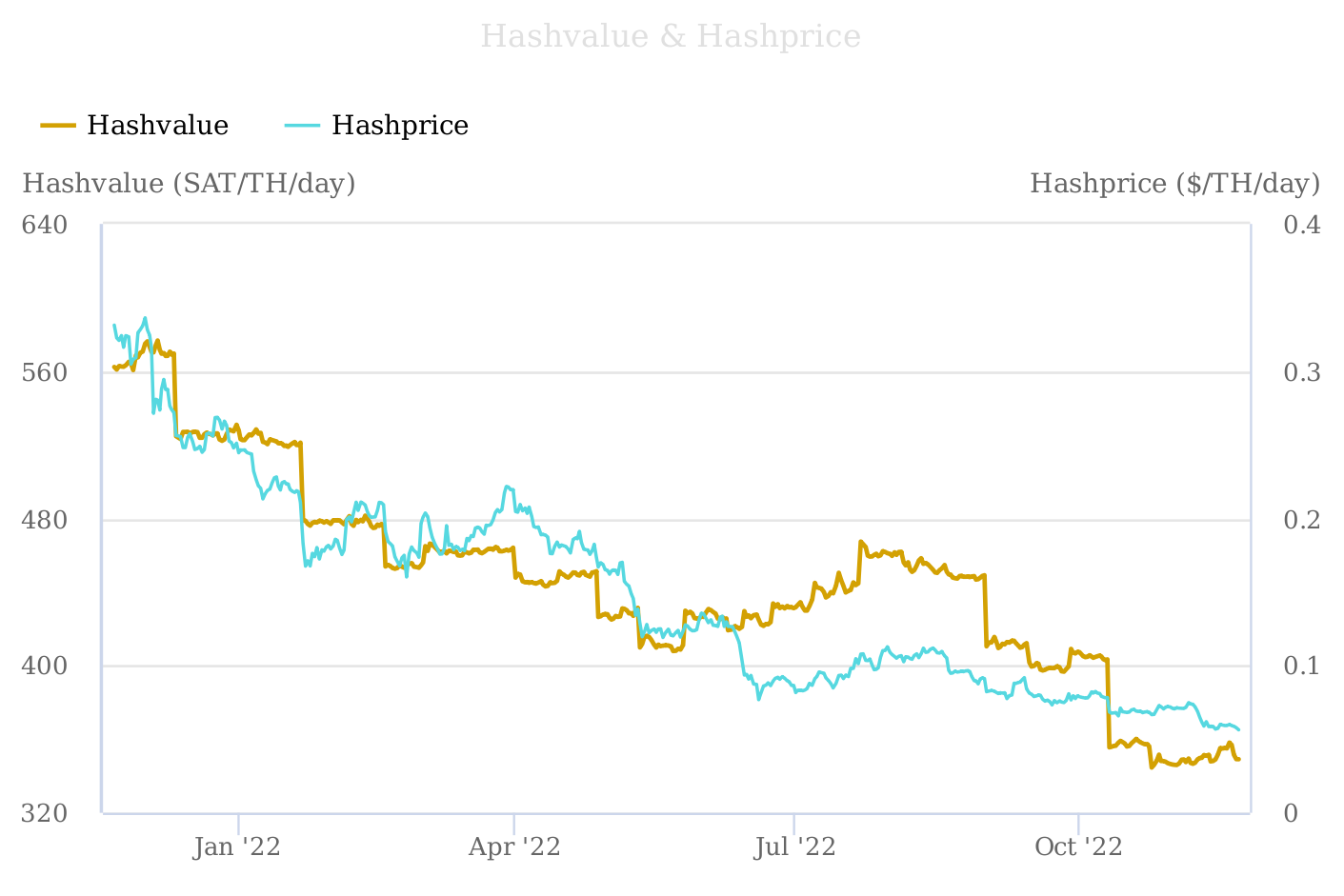

In addition to the metrics showcased on macromicro.me, Glassnode’s hash price chart indicates that the hash price is at an all-time low. The chart highlights a “metric for estimating daily miner incomes, relative to their estimated contribution to network hash-power,” Glassnode’s description notes.

Analytics from braiins.com also indicate that the current hash value is lower than the current hash price. Similar to macromicro.me’s stats, braiins.com metrics show the change occurred around Oct. 6, 2022. If bitcoin prices don’t increase or if they drop lower, a number of BTC Mining operations will face a squeeze out of the industry if they are not facing this situation already.

What do you think about bitcoin’s spot market value dropping below the crypto asset’s cost of production? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

[ad_2]

Source link

RELATED POSTS

View all