[ad_1]

Originally designed as a public ledger for Bitcoin, Blockchain has developed into something much more complex – and much more revolutionary. This is emerging technology at its most interesting, dynamic – and potentially world-changing. Recent estimates put the value of Bitcoin at around the $9billion mark, (although its fortunes have fluctuated a little recently). Bitcoin price went up by a staggering 1,327% in 2017, making it the largest cryptocurrency in circulation.

Every Bitcoin transaction needs to be recorded somehow, somewhere. And that’s where Blockchain comes in.

What is blockchain?

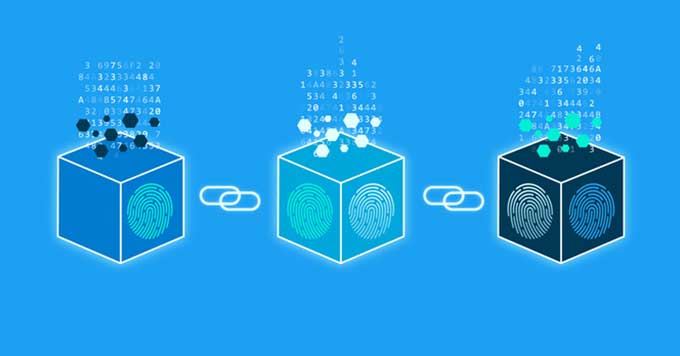

A blockchain is a digitised, open public ledger detailing all cryptocurrency transactions. A ‘block’ is the most recently recorded transaction, so a blockchain is a series of transactions, charting the course of a cryptocurrency transaction from start to finish. It’s an indelible and utterly secure record – and therein lies its power.

Blockchains use a network of nodes rather than a central record-keeping point, and every time a transaction occurs every point in the network is updated. This is known as ‘distributed ledger technology’ (DLT), and is used primarily to verify transactions. However, it is possible to include almost any amount of information into a block, making it an interesting and very different way to process and distribute data, whether it’s financial or not.

Bitcoin isn’t centrally regulated, so it stands to reason that its ledger should be non-centralised, too. What a blockchain does is provide proof of a cybercurrency transaction (primarily Bitcoin). Because each block is encrypted, it’s effectively safer and more robust than other methods of data transference, so it can be moved around but not copied.

There is a downside, though, and that’s when a blockchain increases to a point where it can start to create a storage and synchronisation problem. So shorter blockchains are easier to manage, can be distributed quickly, and don’t take up too much storage space.

Blockchain – an emerging technology with future applications

Information sharing is the fundamental basis of the Internet, but highways can become easily clogged with superfluous data. Most routes are also patrolled by hackers, who can easily pick their way into a data stream and harvest confidential information at will. Where blockchain differs is that data is sent in smaller packages, without any central authority regulating the transfer between nodes. It eliminates the need for third party storage or processing, which is why it’s so perfectly suited for cybercurrency transactions.

How, then, could this technology be applied to other areas? The answer is, relatively easily. Information, whether it’s the details of a Bitcoin transaction of confidential internal memos within a business, is simply a stream of code. A blockchain system allows all the nodes within a network to receive a copy of the blockchain, and all the data contained therein. Imagine, then, a folder filled with all your bank statements, in order, and immediately accessible to anyone with access to that particular network. That is effectively what a blockchain is, but without the possibility of someone outside the network accessing your information.

Safe and secure

It’s a lot safer than it sounds. So safe, in fact, that there are plenty of industries interested in grandfathering the blockchain method of data transference into their existing networks. An open electronic ledger doesn’t just have to list financial transactions. It can be put to good use in diverse settings, from a network of Internet of Things devices, insurance provision, and the sale of diamonds. Its flexible electronic ledger system could even be applied to voting systems, although that may take a little longer to implement.

DLT technology simplifies business operations, especially if your business crosses international borders. It has already begun to replace the creaking, antiquated internal accounting and payroll systems used in the financial sector, not simply because it’s the ‘latest thing’, but because it could also represent a considerable financial saving for businesses too. It’s been suggested that Blockchain could save stock market operators in the USA up to $6billion in accounting costs every year, simply by streamlining and optimising the systems used to move money around – from brokered transactions through to payroll.

Blockchains – a solid investment

Bitcoins have had a bit of a bad press recently, but the truth is that cybercurrency could be the future of finance. With a groundswell away from traditional purchasing methods (seriously, when was the last time you paid in cash for something?) and towards electronic transactions, cybercurrency offers a viable alternative to traditional bank-based transfers. There’s no middleman taking a cut, yet the transactions (thanks to blockchains) are fully accountable and trackable.

New tech companies are investing heavily in blockchains, from Bitcoin loans to cloud storage based on a blockchain-powered network. DLT can be used to store and distribute encrypted information, making it ideal for the transfer of contracts. Even the big names like Microsoft see the potential of blockchains, offering a cloud-based, single entry-point environment for developers and clients.

There are some hurdles before blockchain becomes a go-to system of open ledger data transference. There’s still a lot of back-end programming to interface blockchains into existing business networks, and to be honest, there still has to be some persuading done to convince some businesses that it’s the way forward.

The internet 3.0

Once blockchain has been established, then investing in it could be a good way to get ahead of what will be the next level of online business software. This is the Internet 3.0, and it’s business driven from the outset.

According to a report published by the American Software-as-a-Service Company NASDAQ Private Market, the amount of venture capital being funnelled into both Bitcoin and, more importantly blockchain, is estimated at around $1billion, and rising. Companies operating their own private blockchains could be a buy-low-sell-high tech investment, with a much smaller chance of the bubble bursting before the full potential of the initial investment has been reached.

The Bitcoin/blockchain boom – are you ready to invest?

Obviously, there’s no such thing as a sure bet, but blockchain start-ups are certainly a worthwhile addition to any emerging technology-focused portfolio. The ability to create a business that’s flexible as well as secure (as long as the encryption is flawless), makes investing in the Bitcoin/Blockchain boom an exciting proposition. A plethora of small businesses are now turning their attention away from app building (so last year) and towards blockchain. This, however, isn’t a passing fad, but solid and well-tested technology that could transform the way we all do business on the internet.

Disclaimer

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

[ad_2]

Source link