[ad_1]

While the crypto market still struggles to make a decent recovery, with Bitcoin stuck around $50,500 and Ether just above $4,400, private markets continue to attract new money.

After closing the second fund just two months back, 10T is now launching its third digital assets fund.

The crypto investment firm is run by hedge fund veteran Dan Tapiero and is raising $500 million for this latest vehicle named 10T DAE Fund 3.0, according to a regulatory filing.

The third fund will also target mid to late-stage crypto firms, just like the previous two vehicles.

“They have to be making significant revenue already. We don’t invest in startups,” Tapiero had said of the first two funds.

In September, the company closed its second fund after securing the backing from British billionaire Alan Howard and the state pension fund the Municipal Employees’ Retirement System of Michigan (MERS).

Currently, 10T has just under $800 million in assets under management (AUM), with the majority of the funds already deployed. The fund, founded just last year to offer traditional investors exposure to larger crypto firms, has invested in Gemini, Kraken, Huobi, Bitfury, eToro, Ledger, and Figure, among others.

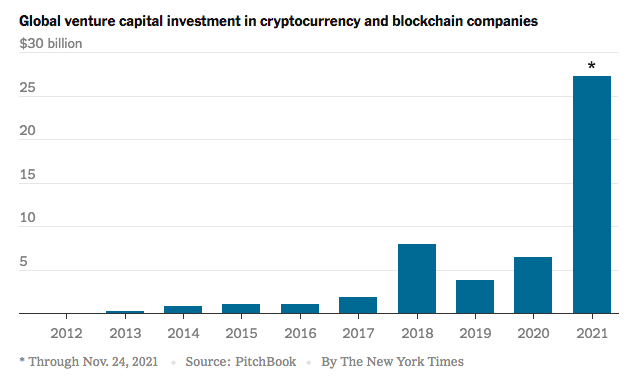

Investment in the crypto market has been growing rapidly this year, as the total crypto market cap went from $780 billion to over $3 trillion in early November.

Sequoia Capital, one of the world’s largest venture capital, replaced the “company” in the Twitter profile with DAO. Shen Nanpeng, head of Sequoia China, said in the WeChat community: all in crypto. pic.twitter.com/1vHV8Yhr5i

— Wu Blockchain (@WuBlockchain) December 8, 2021

Venture capitalists have invested more than $27 billion globally as of late November, exceeding the previous ten years combined, according to PitchBook.

Many of the investments were made by the venture capital arms of crypto companies such as Coinbase. Coinbase Ventures made more deals in Q3 of 2021 than any venture capital firm, as per CB Insights.

[ad_2]

Source link