Crypto Markets Still Flat After Bitcoin Saw Institutional Buying

February 10, 2022 | by olympieioncryptonews

[ad_1]

Crypto markets still flat today after Bitcoin saw an institutional buying and the indicators show that the coin is still far from the overbought zone and could run further as per analysts so let’s read further in our latest cryptocurrency news.

The markets extended their nominal gains on Thursday with the prices of BTC and ETH rising by a marginal 3% in the past 24 hours and most cryptocurrencies saw the little movement as XRP increased 3.3% while SHIB gained 6%. The move showed a recovery in the markets which started last week after a drop a month ago. The total market cap crossed $2.12 trillion and added 2.1% in the past 24 hours with the altcoins outpacing the growth of the cryptocurrencies which led to a drop in the BTC dominance index from 0.4% to 39.6%.

Leading the gains from the altcoins was FLOW, the token from the Flow network. The token surged 11% on Thursday after the gaming app using the network was licensed by the International Olympic Committee to develop a game that is based ont the Winter Games in Beijing. Bitcoin still continues to see institutional demand and some analysts say that BTC saw the demand increase as the prices recovered from under $35,000 to over $45,000 in the past week. FXPro analyst Alex Kuptsikevich noted:

“The benchmark cryptocurrency continues to be in demand after strengthening above the 50-day moving average. This confirms the breaking of the downtrend of the previous three months. For the third week in a row, institutional participants have been investing in crypto funds, according to CoinShare. On the intraday chart, you can see purchases at the close of the American session, which clearly demonstrate the interest of the institutionalists in this region.”

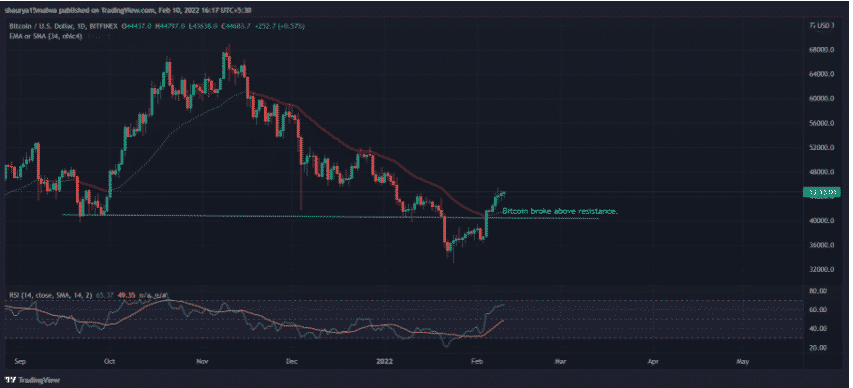

The moving averages are chart indicators that use past prices to calculate and to identify the trend direction of the asset. BTC crossed its 50-day MA earlier this week at the $42,500 price level and stayed above since but the crypto markets still flat seem to be as the continuation of the price movement will imply strength and set BTC for a move even higher. RSI values for BTC hovered at affordable levels as Kuptsikevich said:

“The RSI indicator on the daily charts is now at 61, still far from the overbought zone, confirming that the market is still far from overheating.”

The price-chart tool calculates the changes in the price with a reading above 70 being considered overbought territory and below 30 considered oversold that could precede a change in the trend. In the broader market, the Bank of England and its quantitative easing program helped prop asset prices after the impact of the COVID virus which was on course to book a $4.1 billion loss while in India, the head of the central bank Shaktikanta Das compared crypto to the Dutch Tulip bulb market bubble of the 17th century.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

[ad_2]

Source link

RELATED POSTS

View all