[ad_1]

The DEUS Finance DEI Token loses its dollar peg and crashed by 30% which makes it another algorithmic stablecoin that lost its dollar peg after Terra’s UST so let’s read more today in our latest cryptocurrency news.

The DEUS Finance DEI token trades at $0.66 after recovering from an ATH low of $0.55 that was recorded on May 16. though DEI resembles TErra’s UST in most ways, the stablecoin is collateralized, unlike UST. Deus Finance uses two tokens called DEI And DEUS the DEI is the native governance token while the other is a dollar-pegged stablecoin. The users can mint 1 DEI by depositing $1 worth of collateral so the collateral can be Circle’s USDC, MakerDAO’s DAI, WBTC, and FTM, or a combination of DEUS and USDC with the collateral ratio between them and the native token being 80%. the dollar-peg of DEI is stabilized much like Terra’s UST and leveraged a similar mint and burn mechansim between DAI And DEUS.

During the DEI mining, the DEUS collateral is burned unless a different form of collateral is used so when redeeming DEI for underlying collateral, the DEUS tokens are minted alongside the underlying collateral. So if you mint DEI using only USDC as collateral, when you redeem the underlying you would receive 80% in USDC and 20% in DEUS. Redemption is the process of swapping the stablecoin for the collateral so if the price of DEFI is above $1, the users can mint 1 DEI using $1 off of the collateral and sell them in the market to pocket the difference as a profit.

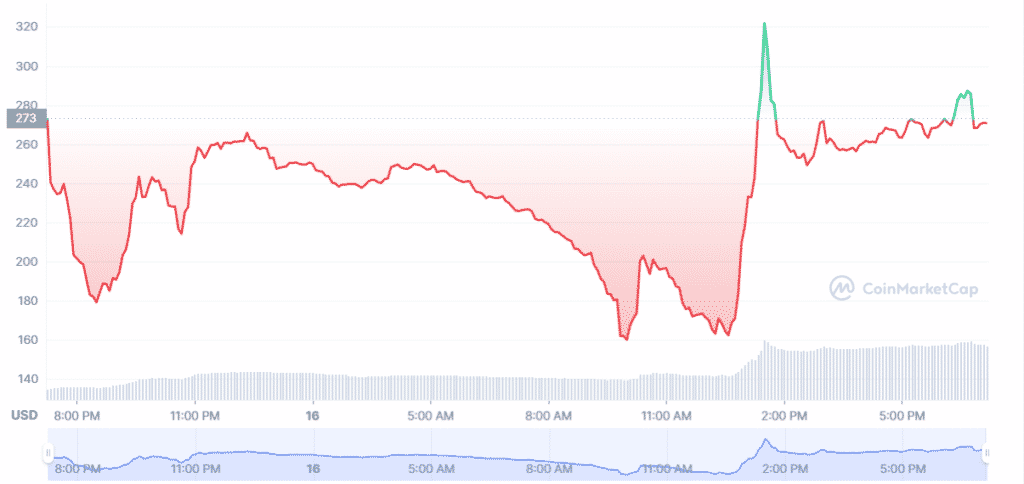

If DEI drops below a dollar, the users can buy one DEI for less than a dollar on the open market and then redeem them for $1 collateral in USDC and DEUS. Over the past two months, the DEUS finance ecosystem suffered two flash loan attacks that led to a loss of $30 million. The DEUS token also dropped by 45% and hit $162 per token so now it trades at $264 from the ATH of $813,282,694 as per the data from CoinMarketCap. The two factors depreciated the collateral value of the stablecoin and brought down the collateral ratio to 43% as per the data from Deus Finance.

With the collateral ratio being so low, the redemptions for DEFI are becoming quite difficult as there’s not enough capital backing the stablecoin. The DEI stablecoin trades below $1 with most users taking advantage of the arbitrage opportunity to purchase the stablecoin on exchanges and then redeem them for a dollar worth of collateral. To reduce the risks of collapsing, the DEUS finance team halted the redemption process and stabilize the coin while they also announced to make the coin fully collateralized.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

[ad_2]

Source link