[ad_1]

Ethereum is under pressure and has just dropped below $1,600. However, on-chain data shows that a crypto whale, “0xb154”, has moved more coins from Binance, a cryptocurrency exchange, to a non-custodial wallet.

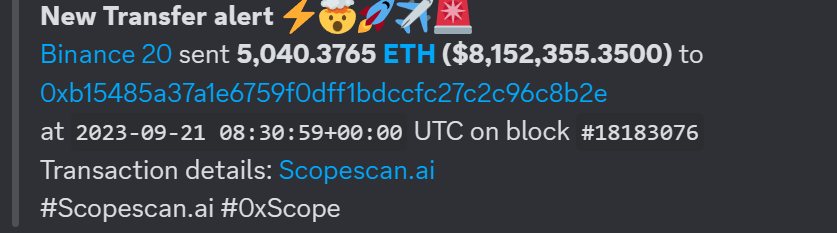

On September 21, the ETH whale transferred over $8.1 million of the coin.

Whale Moves More Ethereum From Binance, Buying NFTs

When crypto prices contract, outflows from non-custodial wallets to centralized ramps, including Binance and Coinbase, tend to rise. This is because centralized exchanges supporting stablecoins or fiat, including the Euro or JPY, offer an interface where they can easily swap for the “safety” of the less volatile fiat currencies or tokens designed to mirror them, including USDT.

That the holder is shifting tokens away from Binance regardless of the heightened volatility can signal confidence for ETH and the broader Ethereum ecosystem. It is not immediately clear what could have motivated the whale to move coins away from the exchange at this point.

However, what’s evident is that ETH is down roughly 4% from September 21’s peak and moving further away from April 2023 highs when it rose to over $2,100.

Records show this is not the first time the whale moved funds. On September 6, the investor withdrew 9,688 ETH worth $15.8 million from Binance. Less than two weeks earlier, the whale notably transferred 22,340 ETH, worth $41.2 million, to Binance.

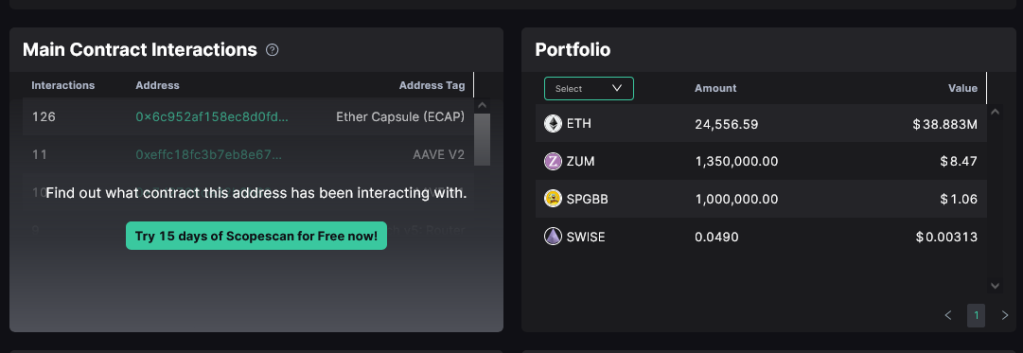

A closer examination of the same address shows it has 24,556.59 ETH worth over $38.8 million at spot rates. Besides ETH, the address controls dust amounts of other periphery altcoins, including ZUM and SWISE.

Apart from simply HODLing ETH, the whale has also been active on the non-fungible token (NFT) scene, looking at historical purchases. Over time, the investor has held over 100 NFTs where, on average, spent 0.2641 ETH; the latest purchase was on September 21.

The investor has been actively accumulating NFTs since early April 2023 and has spent over 35 ETH.

ETH And NFTs Are Fragile

The whale has accumulated more ETH and NFTs when the crypto market is fragile. To illustrate, NFT trading volume is over 90% down from 2021 peaks.

Presently, ETH prices are down 25% from April 2023 peaks. When writing, bears have successfully forced the coin below June 2023 lows as the coin moves further away from the psychological $2,000 level. Candlestick arrangement points to weakness, suggesting that ETH could dump even lower to $1,400—or March 2023 lows, if sellers press on.

Feature image from Canva, chart from TradingView

[ad_2]

Source link