[ad_1]

Gary Gensler says crypto lenders offered “too good to be true returns” and claimed the behavior of some lending platforms was risky and impractical so let’s read more today in our latest cryptocurrency news.

The US SEC Chair Gary Gensler says crypto lenders and lending companies offered unrealistic yields. He referenced yields on deposits ranging from 4% to 20% that were offered by plenty of companies and marketed to the investors as safe:

“If it’s too good to be true, then maybe it is. There may be a lot of risks embedded in that.”

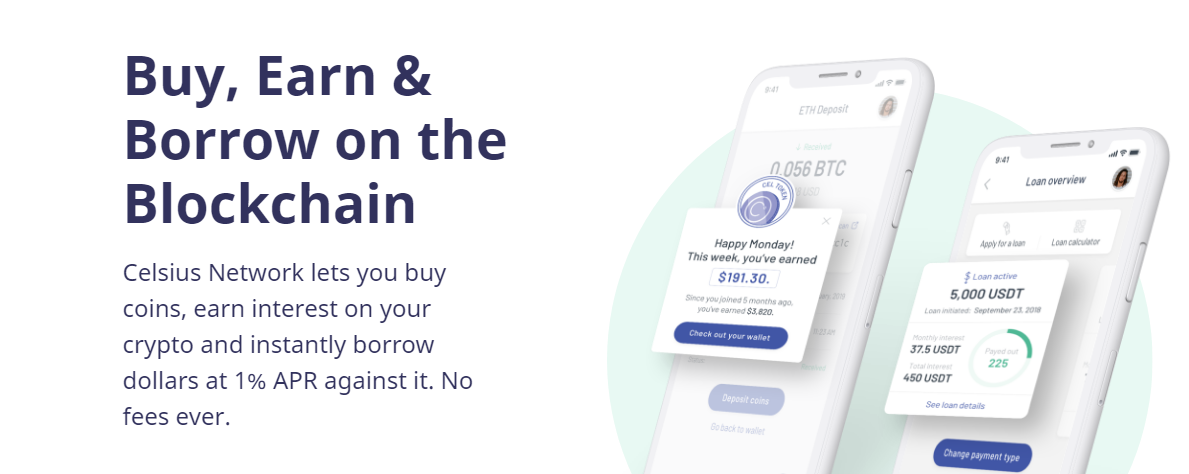

His comments came amid the marekt crash that sent multiple platforms filign for bankruptcy like Voyager digital and Celsius Network. Despite pausing the customer withdrawals, the Celsius website says customers can earn yearly returns of 18% on the deposits for certain cryptos and Voyager touted 12% rewards on the deposits for an uknown token dubbed Kava. Both websites offer high yields on the deposits of stablecoins which are digital assets that often seek to peg their price to the value of the fiat currency.

Also, both websites offered high yields on deposits of stablecoins which are digital assets that often seek to peg the price to the value of the fiat currency like the US dollar and Gensler pointed out the risks related to them as well. Gensler claimed that the main use of stablecoins is a settlement tool in DEFI which is a term that describes the financial tools which enable the borrowing and the lending of assets without third-party intermediaries. Gensler also compared these assets to poker chips which need to be regulated. Gensler said:

“The public benefits by knowing full and fair disclosure and that someone’s not lying to them. You get to decide what risks you want to take, but the person raising the money and the person selling you those financial assets ought to not defraud you, ought to give you the information so you can make your decisions.”

The SEC has rules in place in terms of determining what constitutes an investment company and he referenced the agency’s review of the lender BlockFi where the SEC found the company was noncompliant. BlockFi reached $100 million settlement with the SEC and the state regulators for offering high-interest rates on crypto deposits. The company was in trouble for providing the lack of public information to investors. The broker-dealers and the exchanges are the main groups of business that the SEC will continue to talk about with regard to the SEC complaint in the upcoming months. Reaffirming what he said in the past, Gensler noted that the SEC will have to work with the CFTC and the banking regulators to cover the scope of crypto.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

[ad_2]

Source link