[ad_1]

LUNA is preparing for recovery as three key metrics show but it is still far from its ATH so let’s have a look at the altcoin news today.

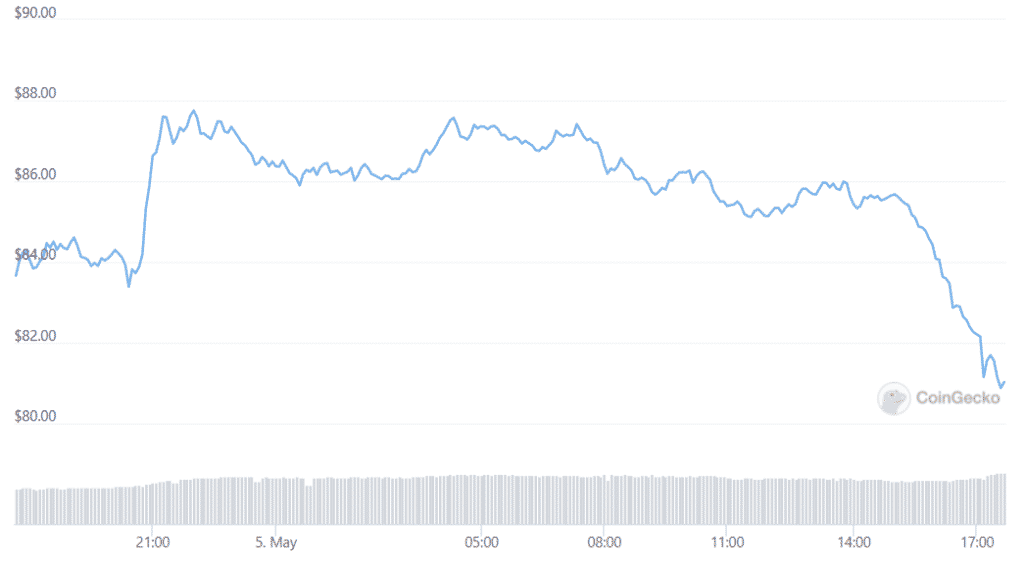

LUNA’s price lost 31% over the past four weeks and erased all of the gains that it accrued year to date and though the token continues to outperform the crypto market by 20%. Terra has a hard time holding above the $85 support line. A few other bullish catalysts were Terra’s UST push to flip Binance USD and become the third biggest stablecoin on April 18 and April 26 announcement that Fireblocks saw institutional clients invest over $250 million into the Terra ecosystem. So now LUNA is preparing for a recovery.

The positive news flow was not enough to instill confidence in the Terra investors and was a few changes that could partially subdue the continuous inflow of the deposits on the network. For example, Anchor Protocol as the biggest DEFI application by deposits, introduced a semi-dynamic adjustment to the previously fixed 20% annualized percentage yield while the rate was cut to 18% and in the future will be reviewed monthly.

Terra’s main decentralzied app metric increased by 41% over the past month as the network’s total value locked hitting a new high at 254 million LUNA. Terra’s Dapp deposits saw a 77% jump in 2022 and reached the equivalent of $21.2 billion and the Binance Smart Chain TVL stands at $9.8 billion with a 9% increase in BNB terms year to date. Avalanche saw a 28% TVL increase in AVAX terms to a $7.9 billion value. To confirm whether the dapp use increased, the investors should analyze the transaction count in the ecosystem.

Anchor holds $16.6 billion TVL or 78% of Terra’s decentralzied application deposits and the protocol averaged 70,150 transactions per day last week and is 15% below the levels in April. Astrosport is an automated market-making project that holds the number two position in the terms of the Terra ecosystem with $1.6 billion worth of deposits. A week ago, the average of 50,650 transactions per day took place with a 30% decline from the previous month.

Terraswap decentralzied asset liquidity application had 31,400 average daily transactions over the past week and the number is similar to the levels in April. The reduced use of Terra Daps doesn’t seem to have impacted derivatives traders’ appetite. The charts show LUNA futures contracts open interest holding at $706 million and the data is critical because the smaller number of futures contracts can limit arbitrage desks. Terra also has the third-biggest open interest behind BTC and ETH and in comparison, Solana and XRP futures contracts hold $660 million open interest.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

[ad_2]

Source link