Markets Show Signs Of Panic As BTC Falls Below $30,000

May 10, 2022 | by olympieioncryptonews

[ad_1]

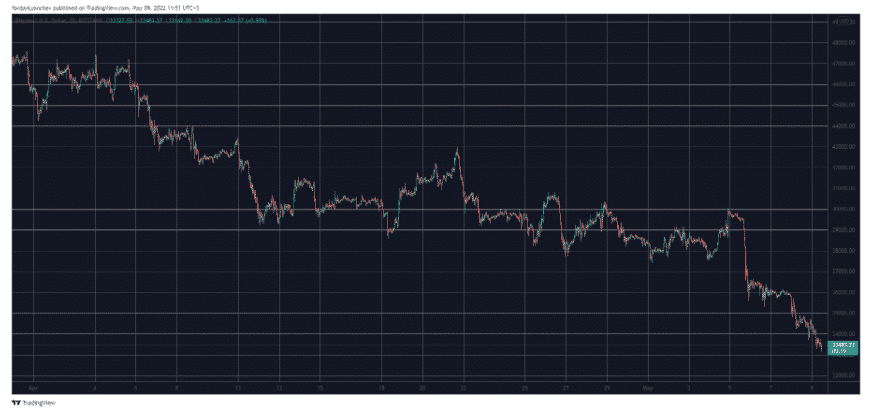

The markets show signs of panic as BTC falls below $30,000 for the first time in a while so let’s read more today In our latest Bitcoin news today.

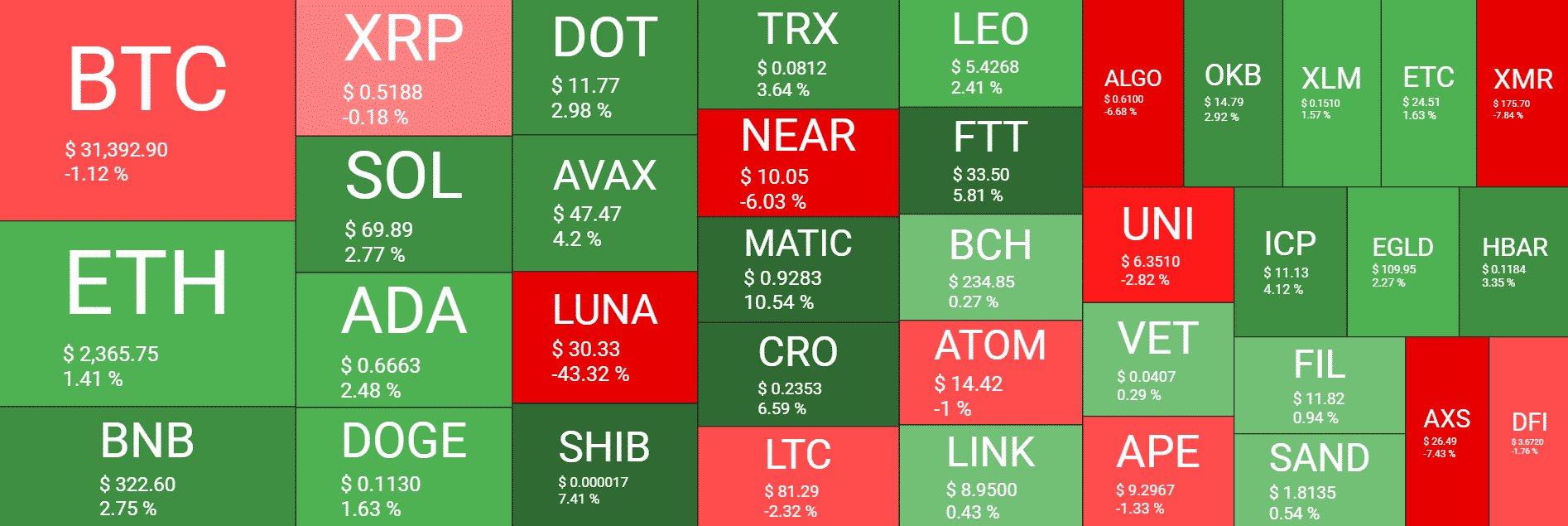

The price of BTC dropped by 11% in the past day to dip below the $30,000 price point for the first time since July 2021 as the markets show signs of panic. It’s more than 55% lower than the ATH of $69,000 that was set in November 2021. Other top 10 coins suffered some double-digit drops and Cardano led the way with a 20% drop, SOL by 16%, and BNB by 16%. All told, the crypto market dropped by 13% from the preivous day and the $1.37 trillion market cap just hit its lowest point this year.

Some stablecoins are faced with some dropping prices as Terra’s UST stablecoin lost its 1:1 peg to the US dollar. BTC and crypto markets became correlated to stock prices over the past year with institutions jumping aboard. Wall Street is having a rough day, as well as tech stocks, continue to go on sale and the Nasdaq index dropped by 4.2%. the decline can be attributed to the issues related to the FED’s determination to quell inflation which is at its highest rate since the early 1980s. the FED last week announced an interest rate increase of 50 basis points while pledging to reduce the holdings and buy bonds instead to stimulate the economy which will be selling them to ward off inflation.

While the news caused an upward swing of inequities and prices thanks to the pre-announcement expectations, the monetary tightening will be even more aggressive whcih is why the markets have been declining ever since. Adding to the market woes is the Luna Foundation Guard’s decision to empty $750 million BTC reserves to shore up the LUNA stablecoin. With one of the biggest BTC holding wallets splashing a lot of coins on the market, it put downward pressure on the price and LUNA dropped over 31% in the past 24 hours.

As recently reported, Terra’s UST stablecoin continued to slip below the dollar peg, and threw money at the problem has yet to work so the Luna Foundation Guard deployed $1.5 billion in reserve assets to shore the stablecoin’s peg. The price of the stablecoin which should be set at $1 continued to drop while the de-pegging happened amid a general market decline.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

[ad_2]

Source link

RELATED POSTS

View all