[ad_1]

MicroStrategy, under the leadership of CEO Michael Saylor, has been making waves in the investment world with its significant Bitcoin acquisitions. The company’s recent purchase of massive Bitcoins has further intensified speculation about the correlation between its Bitcoin holdings and the soaring MSTR stock price.

Meanwhile, as Bitcoin continues to garner institutional interest, questions arise about whether MicroStrategy’s bullish stance on the cryptocurrency is driving its stock valuation or leading to overvaluation.

Bitcoin Boom Aid In Stock Price Rally

MicroStrategy, led by CEO Michael Saylor, has become synonymous with Bitcoin investment, amassing an impressive stash of the cryptocurrency. Notably, the company’s recent acquisition of an additional 9,245 BTC further solidifies its position as a major Bitcoin holder in the corporate world.

In addition, with MicroStrategy’s total Bitcoin holdings now surpassing 214,000 BTC, equivalent to 1% of the maximum Bitcoin supply, attention has turned to the impact of this accumulation on the firm’s stock, and MSTR performance.

Meanwhile, as Bitcoin gains mainstream acceptance, MicroStrategy’s unwavering commitment to the digital asset has propelled its stock price to new heights. In 2024 alone, the MSTR stock surged by approximately 170%, fueled by growing optimism surrounding Bitcoin and MicroStrategy’s strategic Bitcoin acquisitions. Moreover, over the past month, the stock witnessed a remarkable increase of over 65%, reflecting the fervor surrounding the cryptocurrency market.

Also Read: Ethereum Network Struggles With Missed Slots, bloXroute and Lighthouse In Debate

Is MicroStrategy Overvalued Amid Bitcoin Hype?

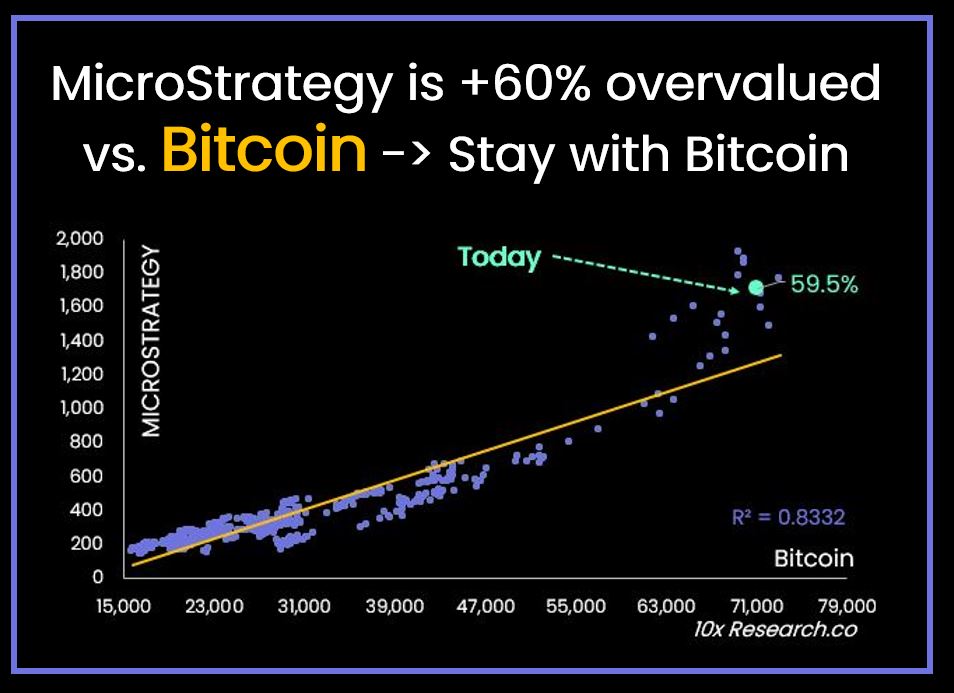

Despite MicroStrategy’s bullish outlook and its impressive Bitcoin holdings, concerns about the stock’s valuation have emerged. According to Markus Thielen’s 10X Research, a prominent crypto research firm, MicroStrategy shares are deemed overvalued by as much as 60% based on regression with Bitcoin. On the other hand, when evaluated against the company’s actual Bitcoin holdings, the overvaluation jumps to nearly 100%.

Meanwhile, Thielen’s analysis suggests that MicroStrategy’s stock price may not accurately reflect its intrinsic value, considering its heavy reliance on Bitcoin performance. While MicroStrategy has emerged as a flagbearer for Bitcoin enthusiasts in the corporate sector, questions linger about whether the stock’s meteoric rise aligns with fundamental market principles.

With Thielen’s research pointing towards a more modest valuation range for MicroStrategy, investors are urged to exercise caution amidst the Bitcoin-fueled euphoria. Meanwhile, the MSTR stock price closed at $1,704.56 on March 28, down 11.18% from its previous session.

Also Read: LUNC Price Rallied 400%, Analyst Predicts Further 270% Upside on Breakout

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

[ad_2]

Source link