[ad_1]

Solana’s price hits 10-month low and it is 85% down from its peak while the coin still faces headwinds from its BTC correlation as we can see more today in our latest cryptocurrency news.

Solana’s price hits a new low and dropped at the beginning of June and brought the net paper losses down to 85% a few months after topping $260. SOL’s price fell by 6.5% to an intraday of $35 after failing to rebound with the conviction from a 10-month low. Now sitting on historically significant support, the SOL/USD pair could see an upside retracement and eyed a $40.45 area next to or up by 25% from today’s prices.

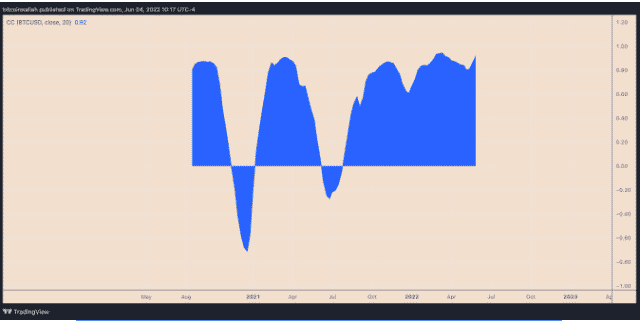

The rebound scenario is far from guaranteed and SOL could fade headwinds from trading in lockstep with BTC as the top cryptocurrency which influences trends across other altcoins. The weekly correlation coefficient between BTC And SOL was set at 0.92 but what’s more, SOL is trying to see bigger losses than BTC if it falls deeper below the current support of $30,000. in the meantime, the Federal Reserve looks quite determined to raise the benchmark interest rates and reduce the balance sheet so as a result, the riskier assets like BTC have room to go lower and hurt Solana’s bullish prospectus.

Breaking below this support level of $35, there’s a chance for a decline towards the $18-25 range which is a strong support area recorded in March and July 2021 and preceded a 1200% price rally. The bearish outlook for SOL came as the Solana blockchain faced a repeated outage which elevated the network unsuitable for the key dapps like the lending protocol Solend and the Serum decentralized exchange. Solana’s latest glitch happened on June 1 and shut down the network for four hours. The blockchain’s biggest outage happened in January and was down for 18 hours.

The outages risk spooking the investors to the benefit of the Solana competition and already coincided with a few traders that rotate their capital somewhere else, Miles Deutscher, an independent analyst believes that crypto investors were cautious after witnessing the recent Terra fiasco but the analyst asserted that Solana’s outages can decrease over time with the network becoming more mature:

“But if they fail to stifle such events, then other L1s [layer-1 blockchains] will continue to eat away at its market share,” he noted.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

[ad_2]

Source link