[ad_1]

Su Zhu of 3AC as one of the founders had a $1.4 billion stake in the company according to an affidavit which also shows that Three Arrows Capital owes Kyle Davies’ wife $65 million so let’s read more today in our latest cryptocurrency news.

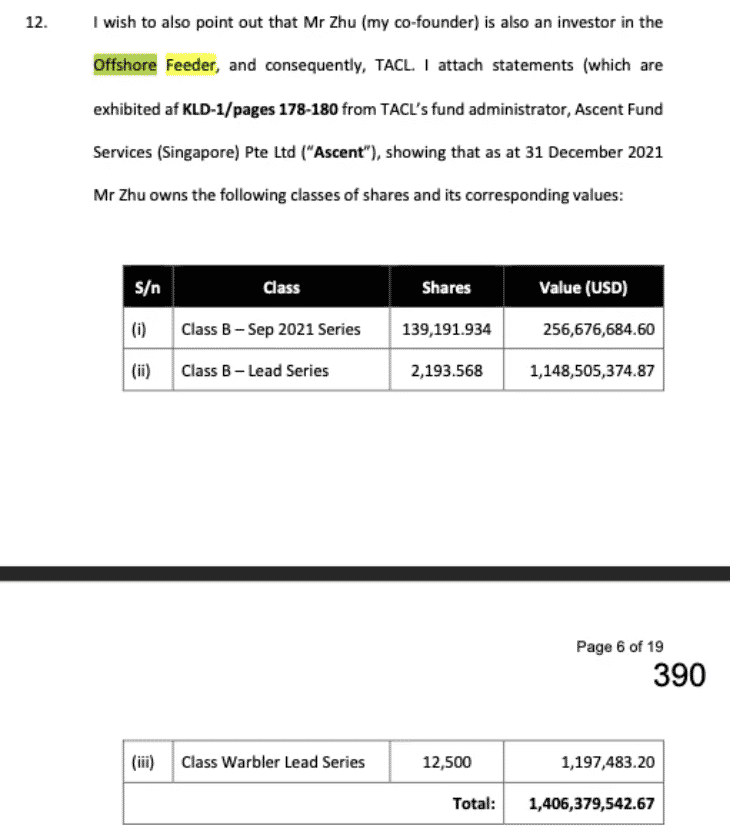

Three Arrows Capital co-founder Su Zhu had a $1.4 billion stake in the offshore fund which pooled the funds’ assets together as per the affidavit from the co-founder Kyle Davies. In the affidavit filed on June 27, Davies said that because of the market downturn most of the value of the investments was wiped out and investors like Zhu suffered immense losses.

Davies also stated that Three Arrows Capital, which is also known as 3AC, owes his wife, Chen Kaili Kelly, $65 million. He also said the company owes Zhu $5 million. The affidavit alogn with liquidator Russel Crumpler and some of the biggest creditors was made public on Monday with Teneo with the company overseeing the hedge fund’s liquidation shared about 1000 pages worth of court documents online. Teneo also took the documents down later that day and already saved and uploaded them somewhere else.

The court documents showed that 3AC owes the creditors a total of $3.5 billion to 25 different companies like Genesis which is being owed $2.3 billion, which is a crypto trading and lending company under the Digital Currency Group umbrella. The 3AC bankruptcy and liquidation was ongoing since July. The court documents showed creditors stopped hearing from Three Arrows in the weeks that lead up to the filing. Crumpler wrote this in mid-June when the co-founder Su Zhu set his tweet saying that 3AC was in the process of communicating with the relevant parties which is the same time the company appeared to have stopped engaging with the creditors.

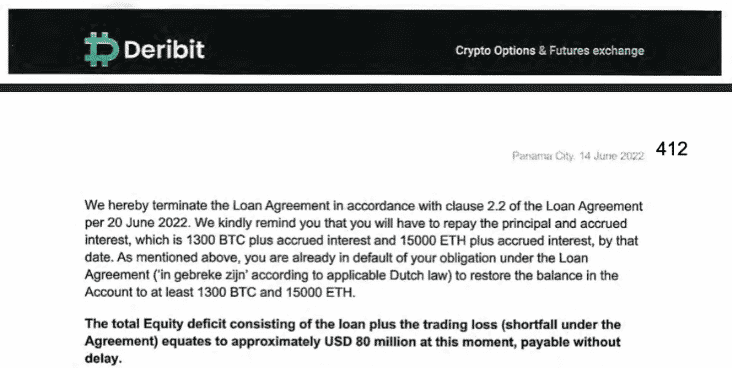

Russel Crumpler’s affidavit from Three Arrows Capital bankruptcy court documents and the reassurance from Zhu didn’t quell fears from the creditors. In the affidavit, Davis said that 3AC was quite overwhelmed with claims from the lenders and investors and received default and demand notices from 32 of the creditors. The creditors include DRB Panama as the parent company of the Deribit exchange. Deribit was founded in 2016 which is the night’s biggest exchange at the time of writing and saw $1.1 billion in volume in one day.

Over the course of three days, DRB Panama said it saw 3AC transfer $30.7 million worth of US dollar Coin and up to $900,000 worth of Tether. Deribit noted that 3AC was a shareholder of the company and said that it considered the debt distressed.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

[ad_2]

Source link