Terra Is The Main Network Of Choice For Defi After Ethereum

March 6, 2022 | by olympieioncryptonews

[ad_1]

Terra is the main network of choice for DEFI after ethereum with the latest rise of the price in LUNA helping it to achieve this milestone so let’s read more today in our latest cryptocurrency news.

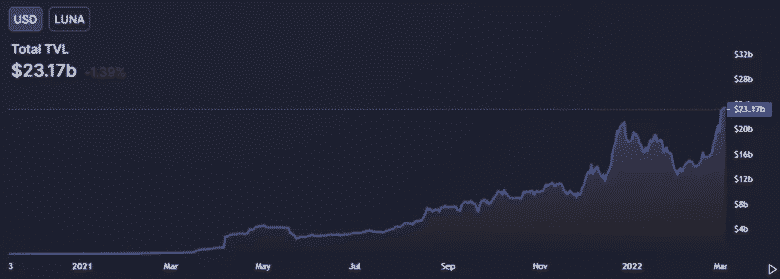

Terra is a fast-growing DEFI tool kit that is built on Cosmos and now it is officially the second largest ecosystem in DEFI. According to the data from DEFI llama, Terra boasts a total value locked of $23 billion which marked an all-time high in terms of US dollars. This is about twice as much as runners-up BNB chain and Fantom while the king chain, Ethereum still dominates 54% of the entire DEFI market that has about $111 billion under its belt.

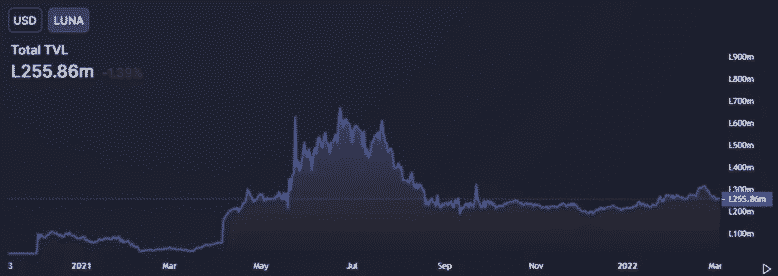

If we take a closer look at the charts of TVL expressing in LUNA, the Terra network native token used to pay transaction fees and vote on governance, the picture looks quite different. The recent spike looks like a minor dot compared to the activity last summer. This only shows there’s an uptick in actual activity and the main motor for the network has been the surging price of LUNA. Coingecko also shows that LUNA increased by 38.8% over the past week and in the same timeframe, the native token behind Terra, Anchor Protocol also surged by 70%. Anchor is a money market akin to Aave where users can earn up to 19.49% on their UST.

Terra is the main network now but there’s a lot of price action giving the Terra ecosystem is a huge boost. The reasons for the latest boost are various. The token for example just started trading on the FTX exchange a month ago. More importantly, the protocol was making $1 billion for a BTC treasury and generated through a luna token sale. Three Arrows Capital and Jump crypto led the raise on February 23 with the funds being used to establish a UST forex Reserve.

The goal here is that the LUNA foundation is a nonprofit organization that can support everything about Terra and will provide the stablecoin with a non-correlated reserve in case of volatile price swings which will keep the UST price pegged to $1. the fact that this reserve is not correlated is important because of the design for UST and LUNA. Reach time $1 of UST is created, $1 in LUNA gets destroyed, and the inverse is also true.

This creates an arbitrage opportunity so if UST falls below $1, the users can buy that UST and swap it for $1 of LUNA. As more LUNA is destroyed to mint UST, the circulating supply decreases and gives the token a similar boost in price.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

[ad_2]

Source link

RELATED POSTS

View all