[ad_1]

Terra’s dollar stablecoin crashed below its dollar peg but Luna followed as it crashed in value below the $1 level so let’s read more about it in today’s latest cryptocurrency news.

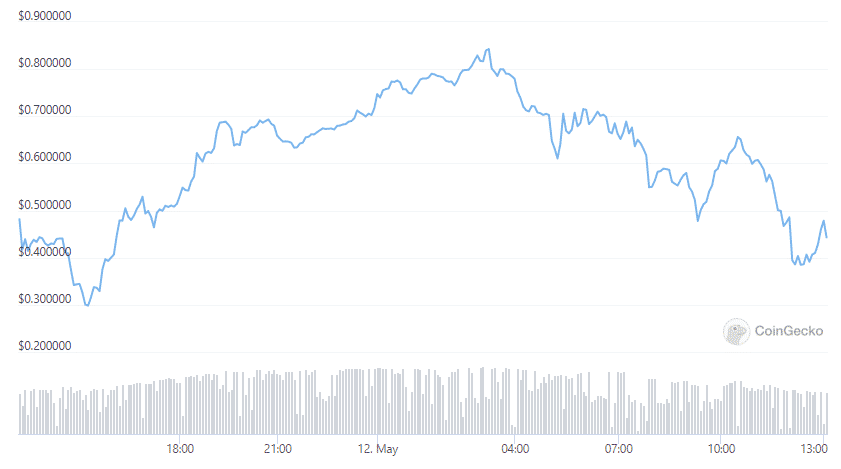

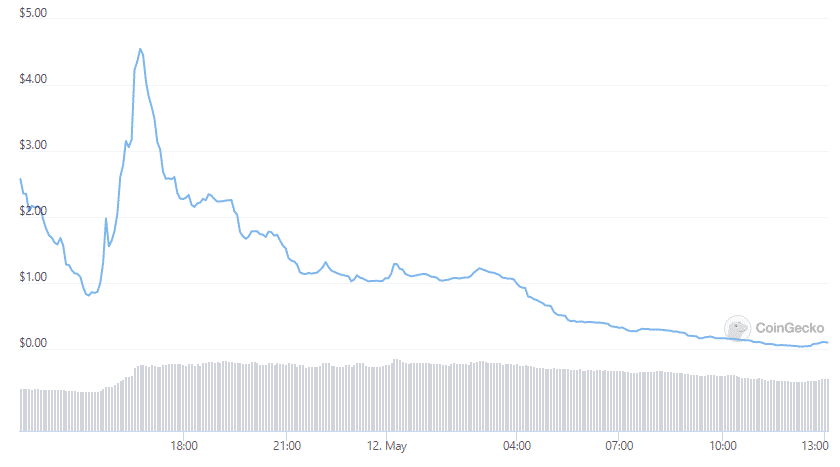

While Terra’s UST trades more than $0.75 from the dollar peg, the currency responsible for maintaining the peg LUNA is also crashing. In what is a historic week in stablecoin history, Terra’s LUNA that backs the UST stablecoin dropped below the dollar as of the time of writing. Terra’s LUNA was worth over $119 in April and now is trading at $0.85. LUNA lost 32% of its value in an hour and the news came after Terra’s dollar stablecoin crashed below its dollar peg and now trades under $0.40.

Terra entered the blockchain business in order to make algorithmic stablecoins that are backed by real-world assets. In the case of Circle and Terra, this means that cash and bonds are behind the stablecoin but Tether’s fidelity to keep the cash reserves has been questioned a few times. Stablecoins are supposed to be fungible with their real-world counterparts so if you want a real dollar, you should be able to trade 1 UST for a dollar anywhere and at any time.

Terra hoped to solve the transparency issues of other stablecoins by foregoing cash reserves rather than creating LUNA. The coin is the wellspring of the value of Terra’s stablecoin as for the digital dollar in Terra stablecoins and the equivalent is burned in LUNA. The opposite is also true so users can always swap 1 UST for $1 of LUNA and then burn the BUST. Over the past 72 hours, the mint-burn mechansim fell apart and UST started crashing which led LUNA to crash by 10% initailly. A $1.5 billion loan from Terra’s Luna Foundation Guard failed to help the stablecoin and then it bottomed further at $0.30 this morning. The event was quite a bad chapter in crypto history and one that hasn’t missed the regulators either. The US Treasury Secretary Janet Yellen pointed to Terra’s collapse as an example of how risky crypto can be which is why we need stabelcoin regulation this year.

As earlier reported, Terra’s price drop from Monday continues and traces below $16 per coin so in the meantime, the network’s dollar-pegged terraUSD stablecoin continues to trade at just $0.8 which is below its dollar peg.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

[ad_2]

Source link