[ad_1]

Despite a sluggish beginning to the month, Ethereum is poised to gain bullish momentum, with key fundamental indicators signalling a potentially positive trajectory ahead.

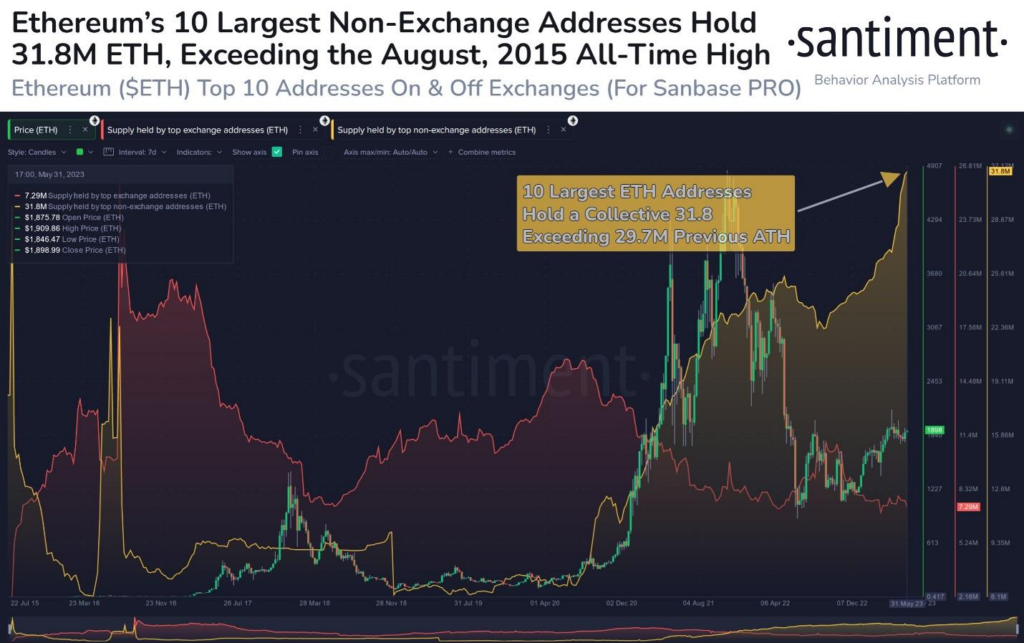

On Monday, June 5th, onchain analytics firm Santiment shared an interesting observation regarding Ethereum’s distribution of wealth. In a tweet, the firm reported that a significant amount of Ethereum has been moving into self-custody and decentralized finance (DeFi) options, consolidating these coins within the largest whale addresses on the Ethereum network.

“As more and more Ethereum has been moving into self custody & DeFi options, many of these coins have been absorbed by the largest whale addresses on the network. The 10 largest non-exchange addresses now hold an AllTimeHigh 31.8M $ETH worth $59.47B,” wrote Santiment.

Notably, the accumulation of these 2.1M coins valued at just over $3.8 billion has continued unabated since 2019, with the holdings of the top 10 non-exchange addresses now surpassing the previous record set in August 2015.

Apart from the allure of discounted prices and the Merge in 2022, these whales’ increased interest in Ethereum can be attributed to the recent Shanghai upgrade. This upgrade has sparked a surge in enthusiasm for Ethereum, leading these whales to capitalize on its potential opportunities.

Today, Cross-chain transaction platform iCrosschain noted that the upgrade has significantly impacted the Ethereum network by enhancing transaction throughput and reducing costs. This has, in turn, enhanced Ethereum’s potential to reshape the crypto world by opening doors to new possibilities and applications.

“With the Shanghai upgrade, more than 3 million ETH has been unstaked on the Ethereum network. Once Ethereum’s Shanghai upgrade permitted withdrawals from staking contracts, Celsius is reshuffling its staked ETH holdings. The amount of ETH on exchanges has decreased significantly in recent times,” added the firm.

These developments and decreased ETH holdings on exchanges indicate an evolving landscape for Ethereum and its potential to revolutionize the crypto world.

That said, just like Bitcoin and many other cryptocurrencies, Ethereum has been facing price volatility in recent weeks, with the second-largest cryptocurrency by market capitalization now facing another rocky start to the week. Despite remaining fairly stable for most of the day Monday, June 5, Ether plunged by about 5.6% after the US market opened to tap $1,785 after the SEC sued Binance for allegedly offering several unregistered securities.

This marks the third consecutive day of decline for the cryptocurrency, with investors now hoping the price can recapture the $1,850 resistance level to avert a further slide southwards. At press time, Ether was trading at $1,884, down 2.50% in the past 24 hours, according to CoinMarketCap data.

[ad_2]

Source link