[ad_1]

Vector Finance TVL hits a new high as Curve Wars shifts to Avalanche In order to become the network’s biggest liquidity hub so let’s read more about it in today’s blockchain news.

The battle to attract stablecoin liquidity was a trending theme on the crypto landscape for the past year as decentralized finance users came to realize the hefty APU which can be earned on the dollar-peg assets. Curve finance remains the undisputed leader in interest that bears stablecoin liqudity pools a few new entrants that started climbing the ranks like Vector Finance, as a protocol that enables Avalanchenetwork users to generate boosted yields on the stablecoin positions.

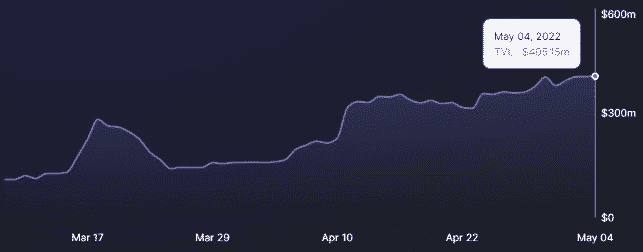

The data shows that the price of VTX underwent a trend reversal as the price climbed 52% from the low of $0.39 to a daily high of $0.60 on May 4. one sign that pointed to an increased inflow of Vector Finance is the rise of the TVL on the protocol which reached a new high of $405.15 million as per the data from DeFi Lama which is notable because of the fact that it came during the time of widespread weakness on the crypto market. The rise in TVL came as the platform integrated new pools from Trader Joe that offers a maximum yield of 69.6% for deposits of JOE/USDC liquidity providers.

The yields for USD Coin and Tether range from 5.1% to 8.0% while wrapped DAI and deposits can earn 3.1%. Vector is focused on accumulating voting power in the Trader Joe and Platypus ecosystem by offering yields of 137.3% for the xPTP-PTP deposits and 129.4 for the Joe-Joe deposits. The users that choose to provide liquidity in the pools can earn another 136.9% APY on top of the yield earned by staking the PTP and JOE tokens on Vector Finance. Another perk attracting liquidity can be the bonus yield of up to 70% for VTX holders that choose to lock their tokens for 16 weeks.

The leading blockchain data analytics platform Nansen released a new analysis report that revealed the crypto market witnesses a decline in 2022 compared to the 2021 activity volume and the report pointed out that the performance of leading blockchain networks like BNB chain, Avalanche, and Polygon stood out as a rising star among the pack. According to the report, Polygon’s scalability and the PoS system, and low gas fees compared to other blockchains like ETH boosted the adoption in 2021 by 1000%.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

[ad_2]

Source link