[ad_1]

Since the summary judgment in the Ripple vs SEC case, XRP has captured the spotlight in the crypto market. Now the fourth-largest crypto by market capitalization, XRP, is currently experiencing a consolidation trend. However, this could just be the calm before the storm as both the activity of large investors aka whales and a developing bull flag pattern suggest.

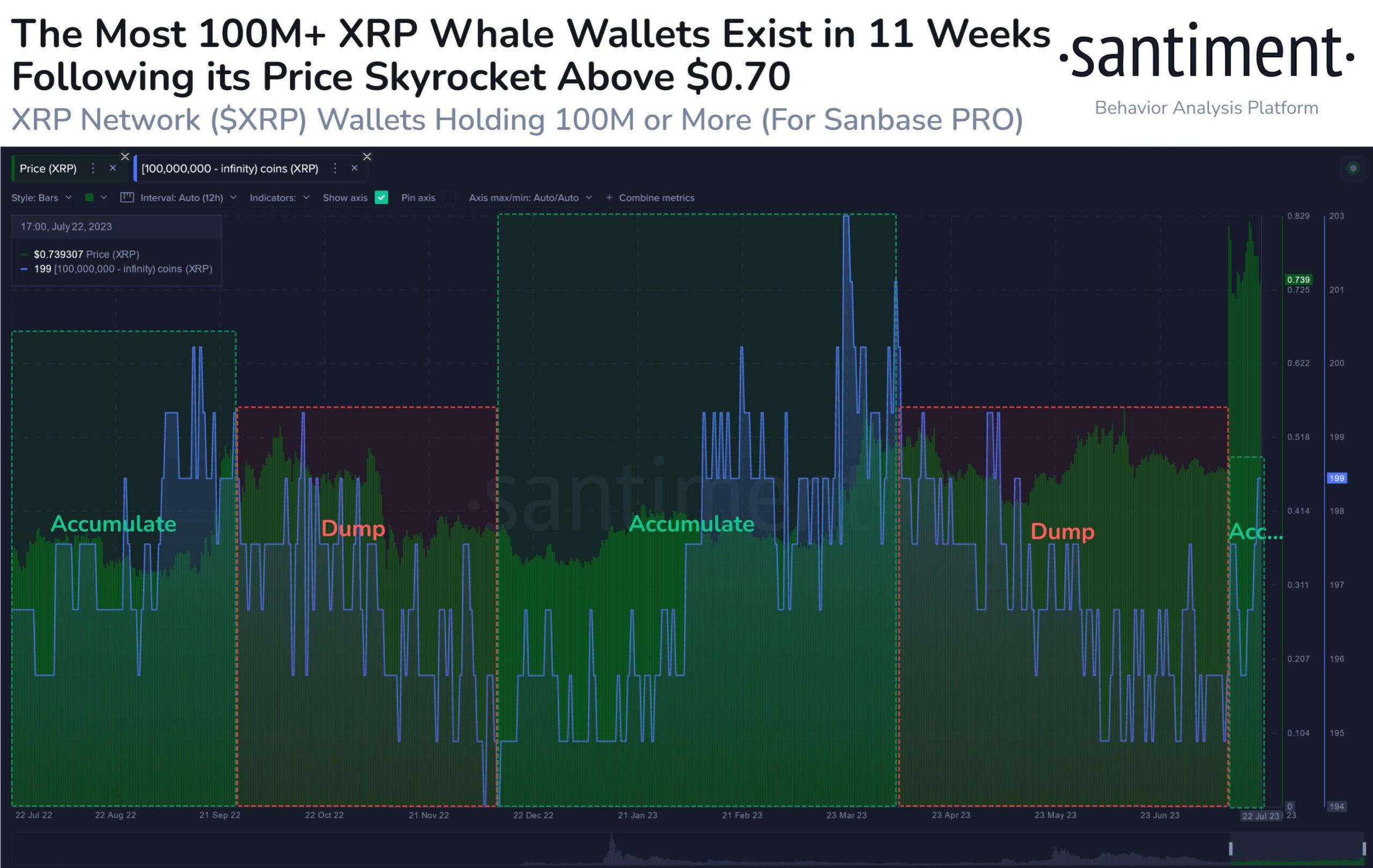

XRP Whale Wallets Reach New Heights

According to an on-chain data analysis by Santiment, a leading market intelligence platform, the number of whale wallets holding a substantial 100 million or more XRP has witnessed a significant increase recently, now standing at an impressive 199. These whales, each commanding a minimum value of $74 million, have been closely observed over the past year, exhibiting strategic buying and selling patterns that impact XRP’s price movements.

This recent surge in the number of whales is a noteworthy milestone, matching the highest figure recorded since May 13. The Santiment chart below shows in detail the distribution patterns of these whales over the past year. As of July 2022, when XRP was trading below $0.40, 200 whales were in accumulation mode. However, they sold when XRP exceeded $0.50 within three months.

Similarly, whales resumed accumulation between December and March 2023 when XRP was trading at $0.41. In April, a larger number of the whales sold their XRP again, bringing the number back below 200. Currently, the beginning of a new accumulation phase could be imminent, as Santiment shows.

Bull Flag Heralds New Rally

The recent meteoric rise in XRP’s price following the Ripple vs. SEC summary judgment has led to the formation of a bullish chart pattern known as the bull flag. This pattern consists of two rallies separated by a brief period of consolidating retracement. The initial rally comes to a pause through profit-taking, leading to a tight trading range as buyers and sellers find equilibrium.

XRP investors have to keep a close eye on the crucial price levels of the bull flag that could determine the future trajectory of the cryptocurrency. To the downside, the $0.685 mark is critical, representing the 23.6% Fibonacci retracement level. Holding above this level is crucial for maintaining the consolidation trend. If the lower end of the range is broken, a deeper correction could be imminent, with potential targets at $0.64 and $0.59.

To the upside, XRP faces resistance at $0.845. Breaking above this level could trigger another sharp rally, though it might require a catalyst, either from the ongoing Ripple case or the broader crypto market, to achieve such a breakout. The closest target would then be the 38.2% Fibonacci retracement level where the impulsive rally following the Ripple ruling ended. Besides the psychologically important $1 level, the next bullish price targets would then be $1.13, 1.33 and $1.61.

Featured image from Binance Academy, chart from TradingView.com

[ad_2]

Source link